“No one can predict how bad the economy will get, but things don’t look good.”

This was the first point in the email sent out by the top start-up accelerator Y Combinator to its founders in May 2022.

Y Combinator isn’t the only one publishing a “black swan” event memo for its portfolio companies.

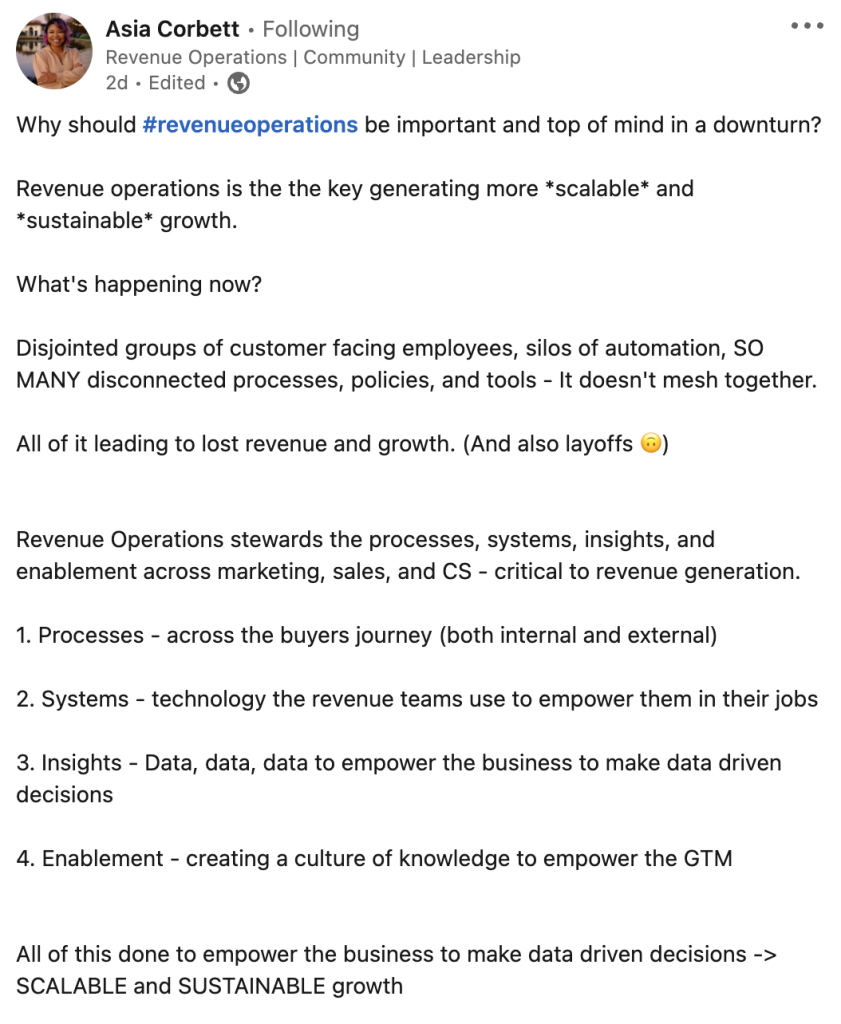

- VC investment firm Reach Capital advised start-ups to “account for an extremely capital constrained environment, even for companies with strong growth rates.”

- Sequoia alerted its start-ups to cut costs or face a ‘death spiral.’

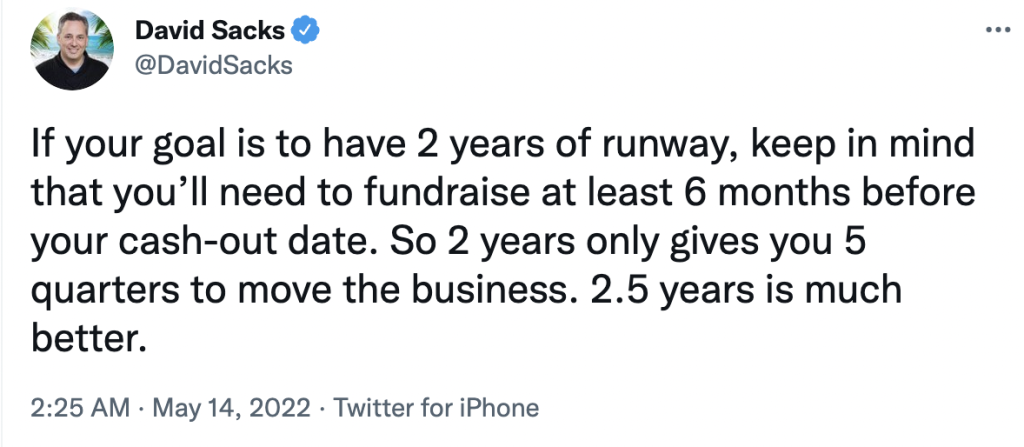

- “This market could still be choppy 15 months from now. So looking at 30 months of runway is a better goal for folks to have,” warned Craft Ventures.

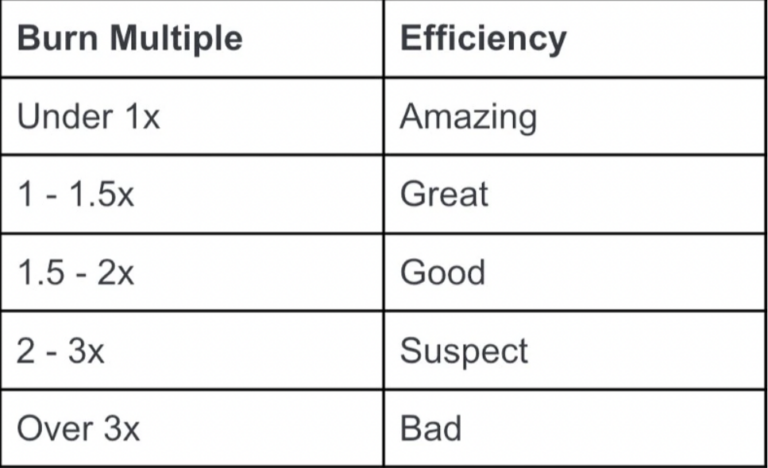

- “Reevaluate your valuation, understand your burn multiples, and build scenario plans” is the advice to start-ups by a16Z.

All this comes in the light of the current downturn in the market. Geopolitical tensions, rising inflation, supply chain disruptions and other sources of market volatility has caused a shift in global businesses.

Public markets have been struggling to adapt to these developments and have seen sharp corrections to valuations. The uncertainty of public markets has trickled down to the start-up ecosystem.

While SaaS companies are considered less risky with predictable business models, the downturn has still plummeted tech stock valuations.