5 CRM Data Challenges that Impact Sales Productivity

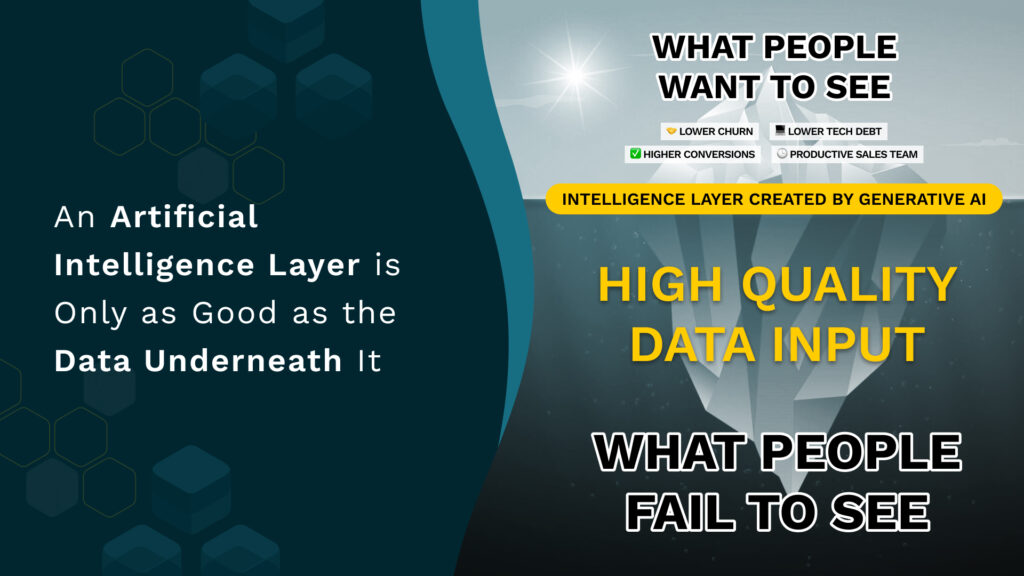

5 CRM Data Challenges that Impact Sales Productivity Sales productivity taking a hit? Missing and faulty CRM data could be to blame. Read this blog to learn more CRM RevOps The ongoing economic uncertainty has slowed down funding to a large extent, prompting revenue leaders to look at business success differently. Cutting down the focus on growth at all costs, they’re now pursuing “productivity at all costs.” So, where should you double down as a revenue leader to boost rep productivity? CRM, the central hub of all sales activity, is the best place to start. CRMs act as data centers for sellers, and those with high-quality data can support highly efficient sales teams. But CRM data leakage (faulty, poor, incomplete, and unreliable data) can disrupt RevOps, resulting in a significant dip in productivity. Missing or Inaccurate Data Bears Risks As much as 79% of the opportunity data collected by reps never steps foot into the CRM. Even worse, reps may capture dirty data (inaccurate, non-compliant, or outdated) when they enter contact information in the CRM. On the other hand, quality data remains stuck in sales tools, inboxes, calendars, meeting notes, and supporting platforms. It’s a rising problem as 91% of CRM data is incomplete, stale, or duplicated each year. Adding to the challenge, 70% of this data decays annually. Source Business decisions made on insights and analysis gathered from bad data cause more harm than any other errors. Following the concept of “garbage in, garbage out,” poor quality intelligence leads to poor quality decision-making. This shortcoming ultimately hampers marketing and sales campaigns. Mainly when there’s no layer of intelligence to enrich sales data, sales reps have difficulty closing deals involving multiple stakeholders in the buying committee. Reps could destabilize multithreading by not having enough accurate information on each participant. For instance, the IT leader may be more interested in understanding the functional and underlying take makeup of your solution. But reps don’t have enough data to arrive at this insight. Instead, they send a generic document to all stakeholders with extensive marketing and financial information, which may be less relevant to the IT team. The result – a flawed customer experience. Let’s see how CRM data leakage affects sales productivity and what you can do to solve the problem. 5 Key CRM Data Challenges Responsible for a Dip in Sales Productivity While there could be multiple reasons for a dip in sales productivity, we’ll look at five significant problems of CRM data leakage that slow down productivity. 1. Incomplete insights on leading indicators 52% of sales leaders report that their CRM costs potential revenue opportunities because the system doesn’t effectively meet their needs. To fuel predictable revenue and motivate reps, you need to know everything happening in your business in real time. Relying on lagging indicators doesn’t help productivity. They’re geared toward past performance and don’t provide information on ongoing deals, such as What opportunities are stuck? Which reps aren’t hitting their quota attainment and why? What are the key channels to communicate with a particular buyer? Reps need insights into leading indicators (predictive measures of future performance) to close deals successfully and repeat winning tactics. These indicators clearly show buyer-seller activity and where deals are headed. Some critical leading indicators are Buyer vs. sales stage Number of sales activities per sales stage Number of multithread deals Multithreading score Productivity score CRM data leakage blocks actionable intelligence on leading indicators. So, reps don’t know what to make of their CRM data. Ultimately, this makes effective selling a challenge. Reps have to look at multiple data points spread across several platforms for critical pieces of information on a prospect. It leaves them clueless about the buyer’s selling stage and affects deal prioritization. CRM data leakage also inhibits you from using a combination of lagging and leading indicators to close deals better. Consider this. Leading indicators allow you to see what new opportunities are created and how many first meetings are done in a given period. From there, you can drill down to see what activities reps undertake to win more deals and how this impacts your pipeline using sales metrics (lagging indicators). Or, if something isn’t right, you can figure out what needs to be done to resolve the problem. None of this is possible without high-quality leading indicators, adversely impacting reps’ selling abilities and productivity. 2. CRM Data Capture Remains Largely Manual For 76% of companies, poor adoption of sales tools is a primary reason they miss sales quota attainment. Moreover, organizations have wasted a considerable amount on sales tools that weren’t fully adopted by reps – an average of $313,000, to be precise. One of the top causes for reps to dislike CRM is manual entry. And it’s clear why, as reps continue to tackle evolving selling processes to attract the evolved buyer. On any given day, reps have to get through a series of simultaneous tasks to win deals, like Researching prospects, their business size, location, target audience, and more. Hosting discovery calls with interested leads. Cold calling and emailing new prospects to refresh the sales pipeline Nurturing stakeholder relationships within a buyer group to push deals through the sales funnel faster Handling internal reviews with peers and managers, exchanging feedback and new selling ideas Amongst it all, entering data manually into the CRM after each buyer interaction feels extremely tedious and unnecessary. Not to mention time-consuming, too. When faced with the massive responsibility of entering contact data, reps spend more time on administrative activities than prospecting and selling (i.e., their core responsibilities). The consequences are disastrous, as non-selling activities add up to one full day of work every week for reps! Sales Reinvented Podcast Reps subsequently prefer putting more time into building buyer engagement. And if they can’t accomplish this feat, they experience a “drag” on productivity. Unmotivated sellers are a wound in the side for sales quota attainment and winning deals. This pushes them to explore other opportunities outside the organization, carving a dent in your bottom line. 3. CRM Acts as a System of Record as Opposed to a System of Actionable Insight