Buyer Intelligence: The Secret to Reduce Customer Churn

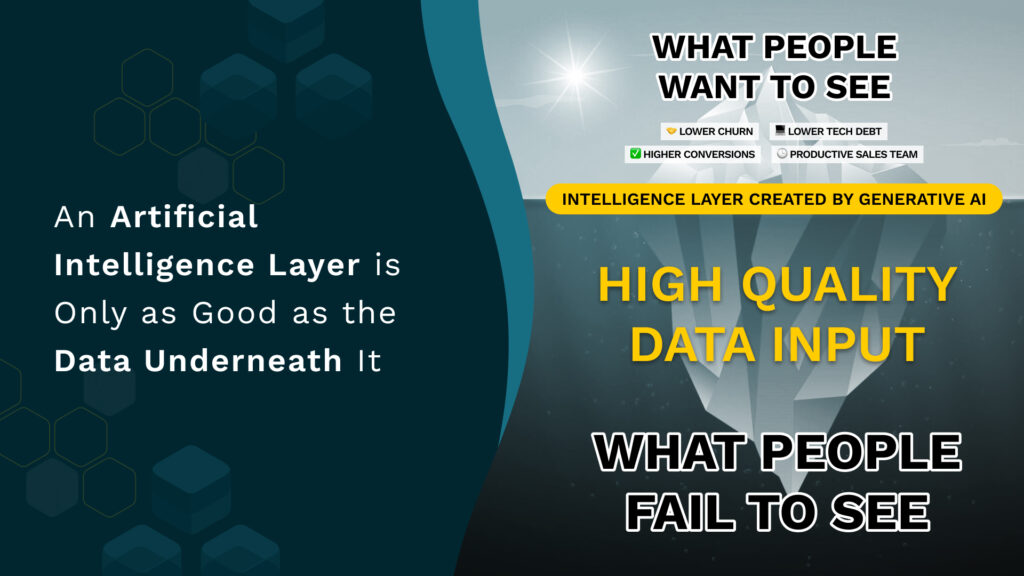

Buyer Intelligence: The Secret to Reduce Customer Churn Churn carries high costs for businesses. Find out how access to buyer intelligence unlocks churn prevention secrets. Customer Success To compensate for one lost customer, you need to acquire three new ones. Believe it when McKinsey says it. Churn carries high costs with it. That’s why retention is a top priority for businesses today. Yet, churn is on the rise, with 64% of companies expecting it to increase. What’s more surprising is that the issues behind churn can be managed or resolved. And as much as 96% of subscription businesses agree. So, how can you uncover the real reasons behind churn, use buyer intelligence to reduce it, and improve growth? Let’s find out. What is Buyer Intelligence? First things first, let’s have a clear understanding of the buyer intelligence concept. Buyer intelligence analyzes past patterns to predict and direct future customer interactions. It assesses ongoing customer data gleaned from omnichannel interactions. Then, it produces insights on these customers. B2B buyer intelligence could look at a wide range of data, including but not limited to: Customer behavior Business goals Business challenges and priorities Purchase decision Successful use cases Communication Company background Segments Financial standing The beauty of buyer intelligence is that it derives this information from several channels. After doing so, it combines and drives insights. Channels include emails, meetings, product usage, service consumption, and more. Its primary goal is to enrich the CRM with complete and reliable data. This gives customer success managers (CSMs) the information to optimize future client interactions. CSMs can use B2B buyer intelligence insights to not just look at customer behavior. They can also dive further into the buyer committee. They can verify contact data and messaging patterns to reach the right stakeholder at the right time. Buyer intelligence is the key to solving emerging problems in customer experience today. Emerging Customer Success Pain Points Resulting in Churn Businesses are strategizing for resilient growth by concentrating on retention. And customer success plays a pivotal role in seeing this effort through. But as the spotlight on customer success shines bright, so do its glaring problems. Notably, the last few years have thrown up multiple issues. Some emerging pain points in customer success include: 1. Customer success rigour doesn’t match sales A singular focus on sales leads to rigorously planned workflows and playbooks. However, leaders don’t follow a similar rigor for customer success. This is despite businesses keeping client experience as their number one priority. 2. Missing engagement Customer success talks to just one person (the champion) instead of engaging with the entire buyer group. This is specifically important as buyer committees are more complex today. 82% of companies say that difficult purchases involve two to nine departments in the client’s company. Other times, CSMs engage with the top 10% (best-performers) and lowest 10% of clients (at high risk of churn). But they miss the remaining customers. These left-out customers could have the potential to become a bigger account (expand) or feel overlooked and leave (churn). 3. Inconsistent information At times, customer success doesn’t know what is happening in the client’s organization. They possess information that is incomplete, inaccurate, siloed, or non-compliant. As a result, CSMs don’t know how to use the available information to strategize the next steps in the customer journey. 4. Too many tools The global customer success platforms market is expected to grow more than double—from US$ 2.07 billion in 2023 to US$ 4.35 billion in 2027. But this growth doesn’t necessarily spell a boon for CSMs. They may have too many tools to gather buyer intelligence from. And end up getting confused. They may not know how to apply these tools to monitor customer behavior. Nor will they know how to help clients make the most of your solution. On the other hand, these tools may also need extensive manual inputs. It becomes overwhelming for CSMs to keep up with the tools alongside other responsibilities. 5. Impersonal client interactions As a result, CSMs can’t personalize communication for each account. Instead, they send generic messages and content for ongoing offers and new features, among other updates. As much as 65% of customers don’t like the impersonal approach, expecting companies to adapt to their evolving preferences. 6. Ineffective renewals Because CSMs don’t have complete information on clients, they hold renewal conversations closer to the due date. There’s no communication or relationship-building activity beforehand. At this time, if you decide to increase costs without an intimation well in advance, customers may be discouraged from continuing with you. The above pain points present a picture of ineffective customer success. What, then, is the effective version? What Does Valuable Customer Success Look Like? Effective customer success is when customers find value in their relationship with your business. And this value is strong enough for them to stick around. Customers assess value by determining their success since deploying your solution. They also look at the experience of working alongside your team. If you deliver high-value experiences to your clients, they’re 3.5 times more likely to advocate for you. But what could CSMs do differently to achieve this feat? Effective CSMs use buyer intelligence to: Work with customers (not despite them) and Understand each buyer’s pain points, business goals, and KPIs. They give customers the resources to be effective, achieve business goals, and feel confident in growth. They don’t create strategies around short-term wins. They also optimize for long-term, sustainable growth. You’ve seen the power of effective customer success. Now, let’s find out how you can build valuable relationships and reduce customer churn using buyer intelligence. The Role of Buyer Intelligence in Reducing Churn B2B buyer intelligence deliberately uses insights gathered from clean data to nurture customers. It enables them to grow with your business, encouraging the customer to associate their success with you. Here are six ways in which buyer intelligence could reduce churn: 1. Single-threaded to multithreaded accounts Poor quality data leads to 56% of CRM users losing existing customers. Owing to incomplete information, CSMs may know who is the day-to-day point of contact. However, they may not know who is involved in deploying and using