Diversifying GTM With Buying Groups, ABM & Operational Excellence

A conversation with Maria Thibodaux, Vice President, Marketing Strategy & Operations at Solarwinds.

Executive Summary

SolarWinds’ VP of Marketing Strategy & Operations, Maria Thibodaux, outlines how the company is modernizing B2B marketing without discarding proven levers. The MQL remains useful, but only as one node in a diversified system that also includes ABX and buying-group engagement, events and channel routes to market, and brand building to earn a spot in the consideration set long before form fills. The operating model leans on governed processes, interoperable tech, and data storytelling to connect disparate signals into decisions sales can act on. AI is applied pragmatically—first to reduce manual load in lead management and routing, then to pilot agents that support expansion and renewals. Throughout, sales and marketing co-own platforms and outcomes, trading “handoffs” for shared accountability.

Key points at a glance

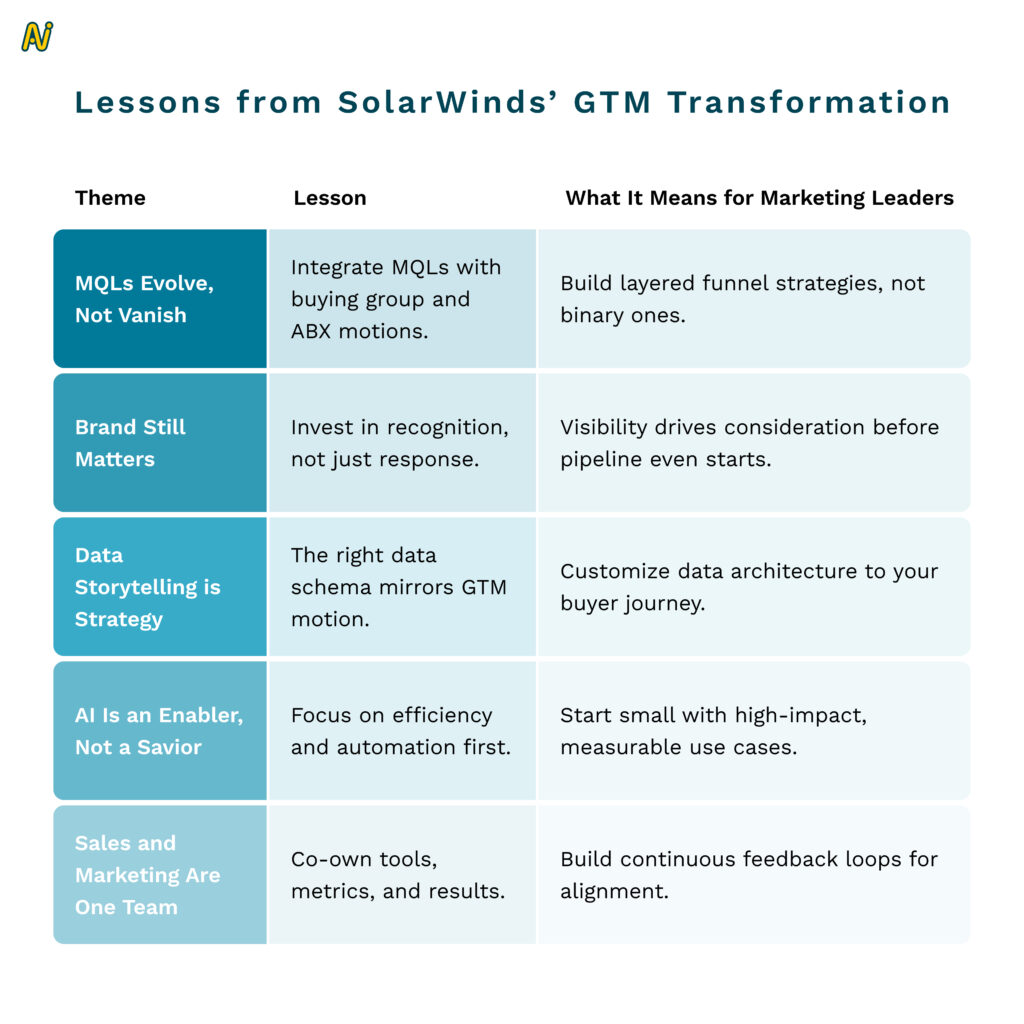

MQLs evolve, not vanish: Treat them as demand capture while ABX and buying-group motions drive depth and coverage.

Portfolio GTM: Balance always-on digital with targeted ABX, buying-group plays, in-person events, and channel to reach specific accounts and regions.

Brand + demand balance: Protect brand investment so you are in the top-three consideration set when buyers self-educate.

Data storytelling over dashboards: Custom schemas and connected data (CRM, MAP, intent, events) mirror the real GTM motion and explain outcomes credibly.

Pragmatic AI: Start with high-impact efficiency (lead management, routing, follow-ups), then test agents for expansion and renewals.

Tight sales–marketing loop: Marketing runs key platforms used by sales and stays engaged post-launch to ensure adoption and results.

Governance matters: Standardized codes, budgets, and processes make multi-touch measurement and experimentation possible at scale.

Introduction

Marketing leaders today are redefining how they measure success, allocate budgets, and engage buyers. For Maria Thibodaux, Vice President of Marketing Strategy and Operations at SolarWinds, the key isn’t in abandoning legacy metrics like MQLs — it’s about integrating them into a broader, more intelligent revenue ecosystem that reflects how modern buyers actually behave.

In this in-depth conversation with The Revenue Lounge, Maria shares how SolarWinds is evolving its marketing operations, blending ABX and buying group strategies, optimizing its tech stack, and leveraging AI to create a seamless bridge between marketing, sales, and customer success.

From Corporate Communications to Data-Driven Marketing Leadership

Maria’s career began in financial services, where she managed corporate communications before pursuing an MBA at the University of Texas at Austin. That move — and a growing fascination with data-driven storytelling — led her to SolarWinds 14 years ago.

“I’ve always loved how data tells a story,” Maria reflects. “It’s not just about reporting numbers; it’s about connecting dots that influence go-to-market strategy and customer experience.”

Today, Maria oversees four critical pillars of marketing operations at SolarWinds:

- Marketing Technology: Managing the GTM tech ecosystem and ensuring alignment with sales systems.

Marketing Operations: Driving governance, budget management, and process efficiency.

Marketing Analytics: Measuring digital performance and campaign outcomes across the funnel.

Strategy: Leading annual planning, QBRs, and strategic alignment across the 200-person global marketing organization.

The MQL Isn’t Dead. It’s Just One Piece of the Puzzle

There’s an ongoing debate in B2B about whether the MQL (Marketing Qualified Lead) is obsolete. Maria doesn’t see it that way.

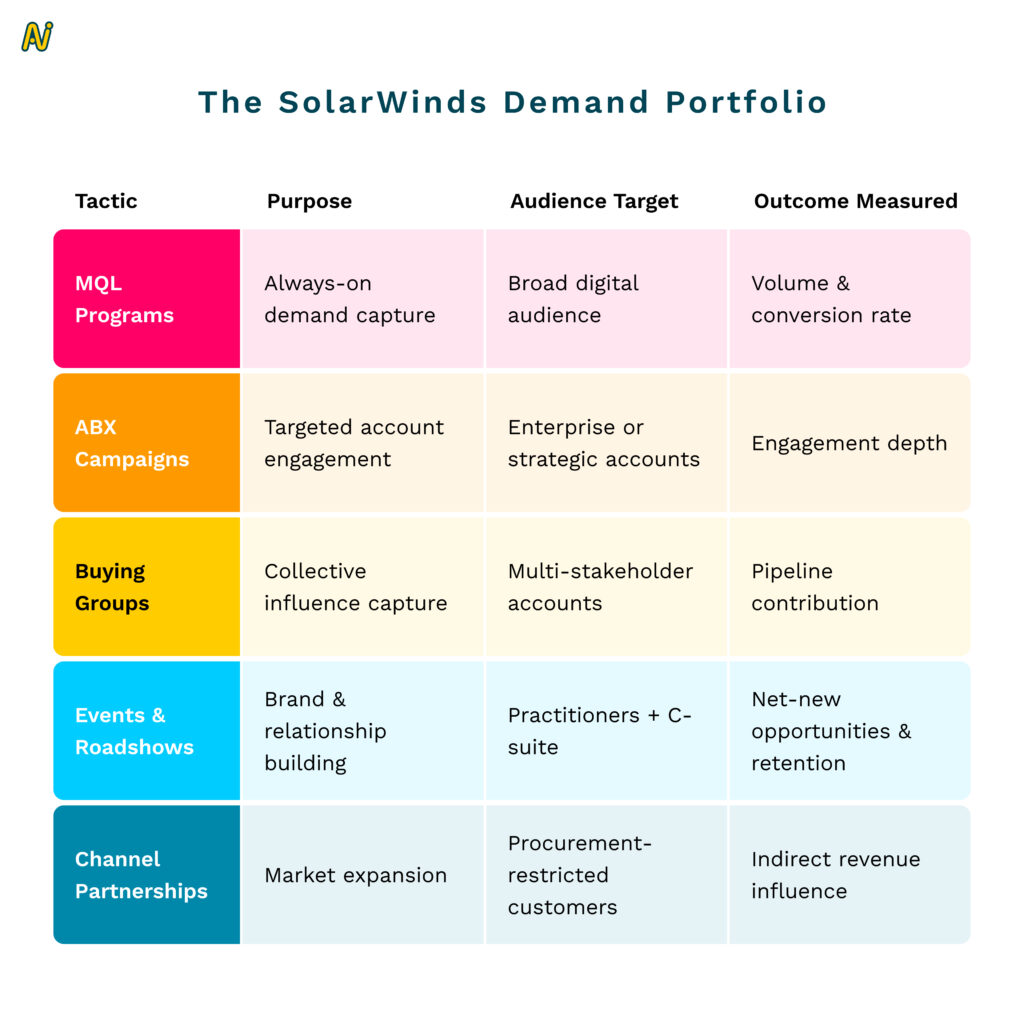

“MQLs aren’t dead. They’re just one part of a diversified demand portfolio,” she explains. “The real challenge is not choosing between MQLs, ABX, or buying groups — it’s figuring out how to make them all work together.”

At SolarWinds, the marketing team treats MQLs as the demand capture mechanism — the “always-on digital storefront” that continues to attract individual buyers. But diversification comes from layered strategies designed for deeper engagement.

Diversifying the GTM Playbook

SolarWinds’ go-to-market model is primarily inside sales-driven, but diversification extends through channels, global events, and localized marketing.

“Our in-person events have been a big bet,” Maria says. “They help us meet customers where they are — and that’s especially effective in global markets.”

The company’s “World Tour” series brings together customers and prospects in regional hubs, driving face-to-face engagement that digital channels often can’t replicate. These events strengthen both the brand and buying-group engagement.

Capturing Buying Groups Beyond the Click

For Maria, the key to engaging buying groups lies in understanding their internal dynamics.

“In our business, practitioners are usually the advocates,” she explains. “They drive the conversation internally, but we still need to appeal to finance, security, and leadership stakeholders.”

SolarWinds uses ABX programs to engage each layer of the buying team — from hands-on IT professionals evaluating product functionality to C-level decision makers focused on cost, security, and scalability.

ABM and ABX: Same Concept, Smarter Tools

Maria believes the concept of ABM hasn’t fundamentally changed — what’s transformed is the tooling.

“ABM itself hasn’t evolved as much as the tools that support it,” she notes. “What’s changed is how we touch buyers — more channels, more personalization, more opportunities for engagement.”

The rise of intent data and signals has made ABX smarter, allowing SolarWinds to identify readiness earlier and fine-tune engagement sequences. But Maria cautions against over-reliance on automation.

“Signals can get noisy,” she says. “The magic is in combining automation with human interpretation to make those signals actionable.”

Buyer Fatigue and the Rebirth of Brand Building

With inboxes overflowing and LinkedIn feeds saturated, buyer fatigue is real.

“We see it in unsubscribes and opt-outs,” Maria says. “The automation overload has made outreach less personal, and buyers are tuning out.”

SolarWinds is responding by rebalancing brand and demand efforts. While digital demand capture continues, there’s renewed focus on brand marketing, PR, and event presence — the levers that strengthen recall and trust.

“Being present where customers already participate matters,” Maria adds. “It’s about showing up consistently, not just showing up when you need something.”

Tech Stack Evolution: From Manual to Intelligent

Maria’s team is evolving their tech stack around efficiency, automation, and interoperability. The essentials remain — CRM, ERP, automation tools — but the focus is on AI-driven optimization.

“Every year it’s less about a new shiny tool and more about how to make existing ones smarter,” she says.

SolarWinds is exploring:

AI-powered BDR automation for follow-up and qualification.

Signal testing and scoring calibration to refine intent accuracy.

Data warehouse-driven storytelling for integrated reporting.

Data Storytelling: Turning Systems into Strategy

Connecting data across systems is one of marketing’s hardest challenges. For Maria, the ability to do that effectively depends on how an organization’s infrastructure scales.

“Data storytelling should mirror how you go to market,” she says. “If your GTM is multi-touch and complex, your data layer needs to reflect that nuance.”

At SolarWinds, analysts build custom schema and models across systems — from CRM and marketing automation to intent and event data — creating an end-to-end picture of what drives conversion.

She calls this “data storytelling at scale.”

The Sales-Marketing Symbiosis

Few things define modern GTM like the sales-marketing relationship. At SolarWinds, that relationship has matured into a codependent ecosystem.

“It’s no longer about handing over leads and hoping for the best,” Maria explains. “It’s about co-owning success metrics and enabling each other with insights.”

Her team manages the platforms that sales uses, ensuring a tight feedback loop and joint ownership of outcomes.

The motto: “We don’t just launch programs; we stay vested in their success.”

AI in Marketing Operations: From Hypothesis to Proof of Concept

AI is moving fast, but Maria takes a grounded view.

“We’re experimenting, not overhauling,” she says. “Lead management is a great low-hanging fruit for AI — it saves time and reduces manual effort.”

Beyond that, her team is building AI agents to assist with:

Inbound qualification and routing

Customer expansion workflows

Renewal and lifecycle engagement

These projects are still in test mode, but the promise is clear — less manual work, more meaningful interactions.

Key Takeaways: Lessons from SolarWinds’ GTM Transformation

Conclusion: The Future is Integrated

SolarWinds’ journey underscores a truth that many B2B organizations are slowly realizing — no single metric, motion, or tool defines marketing success anymore.

It’s the orchestration of them all that does.

“Modern marketing is about integration,” Maria concludes. “It’s connecting strategy, systems, and people — and making sure data tells a story that everyone across GTM can act on.”

Want to hear more stories from revenue leaders? Subscribe to The Revenue Lounge podcast to never miss an episode!

More Resources

A 30-60-90 Day Guide for First-Time Directors of Revenue Operations

A 30-60-90 Day Guide for First-Time Directors of Revenue Operations RevOps 10 min Starting a new job as a Director of Revenue Operations is an exciting opportunity to make a significant impact on a company’s revenue growth. To ensure success in this role, it’s essential to have a strategic plan that guides your actions during the crucial first three months. Here’s a 30-60-90 day plan that will help you strategically manage revenue operations and drive sustainable growth. We recently spoke to Hassan Irshad, Director of RevOps at FEVTutor. He shared his approach to this powerful framework, demonstrating how each phase (30, 60, and 90 days) builds strategically upon the last to deliver alignment, trust, and sustained improvement. By breaking down complex goals into achievable milestones, the 30-60-90 day approach empowers RevOps leaders to initiate meaningful change without overwhelming teams. For all the RevOps leaders, it’s a way to approach change with purpose, driving measurable impact and laying the groundwork for long-term success. The 30-60–90 day framework must be an indispensable tool and here is how you can implement progressive, sustainable growth strategies from day one. First 30 days for a Director of Revenue Operations The purpose should be to gather insights and understand the organization, especially the needs and challenges of different teams. 1. Goals for first 30 days: i. Meet Key Stakeholders Meet with cross departmental teams like Finance, HR, and Sales to understand their goals, challenges, and priorities. ii. Document Everything Create a “lay of the land” document summarizing findings on different team goals, challenges, and processes. iii. Understand the Product Take product demos, listen to sales calls, and use tools that show how the product is sold. This helps in understanding the customer needs better. iv. Dive into Your CRM Understand your CRM (whether Salesforce or HubSpot) to assess how the data is organized. This is to check whether it’s easy to use, and identify immediate improvements. The CRM should be the central source of truth, with other tools supporting it. The data should be unified with easier adoption for the teams. v. Build Trust Internally Establish trust within your teams by listening carefully, asking questions about how RevOps can help, and addressing quick fixes to show you’re there to help. Having this trust shows them that you’re here to support their success. Quick wins, such as small fixes that make people’s jobs easier, helps in establishing credibility early. 2. Establish Clear KPIs i. Understanding Team KPIs It is important to ask you stakeholders about the KPIs that matter to understand their goals and what their expectations are. ii. Aligning KPIs Across Teams Different departments oftentimes work in silos. RevOps should strive to align these departments and check if these KPIs match the overall business objectives. Gaps must be closed if their KPIs don’t align. iii. Setting RevOps KPIs As you approach the end of the first 30 days, start establishing RevOps-specific KPIs that match company goals, which may involve metrics like revenue increase, conversion rates, or improvements in overall efficiency. 3. Tech Stack Audit Deep dive into the existing tools that your company is using. Identify all redundancies, and find opportunities to streamline the entire tech stack. i. Map Out Tools Compile a list of all tools used by teams, noting their purpose and how they work with the CRM. ii. Evaluate Use and Cost Determine if tools are actively used or if there are duplicates. Look for cost-saving opportunities by consolidating tools when possible. https://www.youtube.com/watch?v=sVDJ9KI1tGw&t=869s Next 30 days – Alignment and Control The next 30 days marks a shift from discovery to alignment. The goals should be to create cohesion between departments (e.g., Sales, Marketing) and laying down effective controls. The improvements need to be implemented without overwhelming the teams. This phase combines further exploration with actionable improvements with the primary task being bringing the teams into sync. 1. Ways to bring your teams together i. Encouraging cross-team collaboration by addressing silos and ensuring all teams work toward shared quarterly or company-wide goals. ii. By creating alignment, you help teams see RevOps as a support system rather than an enforcer. This keeps communication channels open and creates buy-in. iii. Based on your findings, introduce controls wherever needed to improve workflow. Example: If close dates aren’t being recorded properly, this could skew reports. Meet with sales, identify the root cause (e.g., manual data entry that is taking too much of a reps’ time), and provide solutions or tools to make their tasks easier. Ensure that controls are practical and developed with the trust built in the first 30 days. Foster internal consensus within teams so that these improvements are adopted seamlessly. 2. Navigate Organizational Politics (i) Barrier Removal Larger organizations may have internal politics or ingrained processes that resist change. Find an internal “sponsor” who trusts and supports RevOps initiatives and can authorize actions to navigate any resistance. (ii) Trust and Consistency As you implement changes, make sure your efforts consistently demonstrate how RevOps can make work easier and more efficient for everyone. 3. Evolving the Tech Stack (i) Assessing Tech Needs If tools aren’t fully integrated (e.g., a tool not writing data back to the CRM), identify their gaps and consider evolving the tech stack. (ii) Holistic View Use insights from the discovery and alignment phases to start envisioning necessary tech improvements that align with company goals. Beginning of the 90-Day Phase: Vision and Execution This phase, described as “Vision and Execution,” involves shaping and executing a strategy based on insights gathered from the discovery and alignment phases. a. Roadmap Creation Create a roadmap covering the next two quarters, focusing on long-term, high-impact changes that align with business goals. Use learnings based on stakeholder needs, organizational goals, and the findings from the first 60 days i. Set Priorities Collaborate with end users (Sales, Marketing, Customer Success) to understand their pressing needs and align the roadmap with these needs. ii. Strategic Execution Prioritize initiatives that will have immediate revenue impact or

Top 10 Relationship Intelligence Tools for 2025

Top 10 Relationship Intelligence Tools for 2025 RevOps 10 min When it comes to sales, building strong relationships is essential. But let’s face it, the process can be incredibly time-consuming and demands a significant amount of effort from the sales reps. But here’s the kicker: Today, 44% of millennial buyers prefer minimal contact with a sales rep during the buying process. That means your sales rep has ~5% of the prospect’s time to establish a connection. It’s tougher than ever to develop relationships from a seller’s point of view. Does this mean that your reps should stop building relationships? Should your reps just try and sell whatever they can to whoever you find? The answer to that is a resounding NO. In the digital era, data and insights are what drive sales . They have the potential to give out more information than you know about your prospects. CRMs capture all possible data, churning it and spurting out information that otherwise was not visible earlier. But wait. There’s more to sales success than your CRM. To truly understand your prospects, you need to dig deeper to uncover hidden insights to help close your deals faster. That means mining your CRM data for a wealth of valuable information that will give you a competitive edge. This is exactly what relationship intelligence does. What is a Relationship Intelligence Tool? Picture this: You have access to a wealth of data from your clients, colleagues, and partners, but it’s scattered across various touchpoints like emails, phone calls, messages, meetings, and more. How do you make sense of all that information? That’s where relationship intelligence comes in. By pooling in, processing, and analyzing all that data, relationship intelligence technology provides invaluable insights, builds stronger relationships, and helps you make smarter decisions. With relationship intelligence, you can discover a treasure of data-driven and actionable insights that support the organization’s understanding of the customer, identify the optimal solutions, and determine the best communication strategies. This results in a more tailored and informed approach to prospects to maximize the best chance of a positive outcome. Your prospects are more than just a phone number or an email. Relationship intelligence broadens your potential and plays a strong role in connecting the dots from other sources. It supplements your CRM, finding other & useful opportunities to close prospects, otherwise not visible to us. Why Does a Relationship Intelligence Tool Matter? Enterprise-based selling in B2B is no walk in the park. With a plethora of relationship intelligence tools out in the market, organizations are spoilt for choice. However, tools that leverage AI/ML, offering data-driven intelligence with invaluable and actionable insights, will be the ones that will dominate the market. On the flip side, the process of onboarding a tool no longer rests in the hands of a single decision-maker. Gartner states that the number of buyers involved in the last decade has increased from 5 to 20. A potential account will have multiple stakeholders who will be involved in the decision-making process. Hence, it becomes critical for sales reps to identify and engage with key stakeholders regularly. With the rise of digital selling, organizations can now track the process of selling in a more in-depth manner. All forms of digital outreaches and communication with prospects can now be tracked, analyzed, and acted upon with the help of relationship intelligence. Today, with markets being down and companies being extremely meticulous in their choice of tools to invest, having a relationship intelligence tech stack will be the game-changer. Here’s how 1. Showcasing a single view of all your relationships with your prospects Having relationship intelligence data will bring together all the stakeholders in one view, so sales reps have a clear idea of the sales cycle the account is currently in. 2. Identify every stakeholder involved With the buying process evolving constantly, the final decision often lies not with one but multiple owners. In other words, for a sales rep, multithreading is the best way forward. And in this process, it’s very easy to confuse the right person to engage with, especially if there is a handover involved. Sales reps often fail to map out the stakeholders involved. The dots are not connected and not visible, which can lead to confusion and no clarity to other higher authorities. Relationship intelligence tools fill these gaps. It will identify each & every stakeholder involved at every stage of the selling process, bring them together, and map out the relationship of each, and provide all the information about these stakeholders. Not only that, but the data also provide insights to those who are frequently engaging and also point out the next best champion to continue the sales process seamlessly if the key decision maker is unavailable at any stage of the sales process. 3. Give detailed insights about each prospect The thing about relationship intelligence tools is that not only do they provide details in one place, but they also show you the best possible way to contact and reach out to your prospects. It can be email, phone calls, or video calls; it will give you solutions that are sure to boost your process of converting. 4. Recover lost leads In the world of sales, not all leads or prospects will convert. If the target is to convert 2 leads in a month with a value of X, sales reps need to build a pipeline of at least 10 leads with a value of 10X. This results in 8 leads that will not convert or be disqualified or lost in the process. However, these 8 leads don’t have to be lost forever. With relationship intelligence, you can identify the most engaged buyers and reignite the relationship with them. And here’s the kicker: the relationship intelligence technology considers all the data even before onboarding the tool. This kind of intelligence will only unleash hidden superpowers for your sales reps. Who knows, your lost prospect’s business priorities might have changed over time, and getting back to them might just make all the difference. 4. Discover trends in

5 Steps to Navigate Buying Groups in 2025: A RevOps Guide

5 Steps to Navigate Buying Groups in 2025: A RevOps Guide RevOps 10 min In today’s business environment, B2B buying is never just one person. According to Forrester Research, more than half of global business buyers purchase in complex buying scenarios that include more people, more departments, and generally higher price points. And this buying group can be made up of 7 to 20 people! Unlocking the power of buying groups is a crucial aspect of the B2B landscape. This blog is a synopsis of our conversation with revenue operations leader, Nandini Karkare. She is currently the SVP of RevOps at Zywave. Nandini suggests strategic steps to navigate through the realms of Revenue Operations and helps uncover the strategies, insights, and best practices that constitute a comprehensive guide to mastering the dynamics of buying groups. Read on to get actionable tips on how you can navigate buying groups in 2025 (and beyond). And implement the learnings to create a winning GTM motion. Here are the 5 steps Nandini recommends: 1. Decode Your Buying Groups The buying groups typically consist of members from departments and they all contribute different aspects. It is critical to understand the scope of decision-making including the people who play the most significant roles in making the call. Gartner’s report on B2B Buying highlights that 77% of B2B purchases involve a buying group of four or more people. PS: The key stakeholder can turn out someone altogether different from who you had building a relationship with all along. a. Capturing Buying Group Members Effective buying group management means considering not just decision-makers but influential stakeholders across departments. Misidentifying key players or focusing solely on the main contact risks derailing the sale. (i) How can you map the entire buying group efficiently? Leverage internal and external data to identify the key players Segment the Group by Role and Influence (ii) Not everyone in the buying group holds equal power or influence. Segment them into categories: Decision-makers (who give the final heads-up) Influencers (who sway the decision) Users (who use the product and provide feedback) Budget owners b. The Role Transition Within a Buying Group Moving the focus from a buying group to a renewal or expansion committee includes knowing precisely who remains in the relationship, as well as who becomes more active as an account grows. (i) New roles may emerge in a Buying Group Technical or operational leaders may become more influential post sale, since they are now using the product. (ii) The focus shifts from buying to renewal The interaction should be more about the return on investment (ROI) of the product placed on the market, ongoing value delivery, and ongoing needs. (iii) Alignment between the buying groups and renewal committee Leveraging the same enthusiasm and relationships generated at the first-buying stage helps in anchoring the transitions and preventing any drop-offs in engagement. Related Resource: Navigate Enterprise Buying Committees: Strategies for Driving Alignment c. Understand the Personal and Collective Priorities of a Buying Group As per McKinsey & Company, B2B buying decisions increasingly require engagement across departments, with 60% of purchasing committees including members from outside traditional procurement, like IT and HR. (i)Alignment Between C-Suite and Technical Teams Decisions aren’t Made in a Vacuum Collaboration between C-suite and technical teams ensures a holistic approach to solving customer problems, creating stronger, more sustainable relationships Their cross departmental collaboration can help with: (ii) Alignment on Strategic Goals C suite executives need technical assistance to translate their strategic vision to reality that also aligns with company-wide objectives. (iii) Technical Validation These insights guide the C-suite in making informed decisions that fit technical infrastructure and future-proofing. (iv) Cross-functional Communication Bridging the gap between these two groups involves continuous, open communication, ensuring that technical evaluations don’t delay business goals but instead support them cohesively. iii. Understand the Product Take product demos, listen to sales calls, and use tools that show how the product is sold. This helps in understanding the customer needs better. iv. Dive into Your CRM Understand your CRM (whether Salesforce or HubSpot) to assess how the data is organized. This is to check whether it’s easy to use, and identify immediate improvements. The CRM should be the central source of truth, with other tools supporting it. The data should be unified with easier adoption for the teams. v. Build Trust Internally Establish trust within your teams by listening carefully, asking questions about how RevOps can help, and addressing quick fixes to show you’re there to help. Having this trust shows them that you’re here to support their success. Quick wins, such as small fixes that make people’s jobs easier, helps in establishing credibility early. 2. Establish Clear KPIs i. Understanding Team KPIs It is important to ask you stakeholders about the KPIs that matter to understand their goals and what their expectations are. ii. Aligning KPIs Across Teams Different departments oftentimes work in silos. RevOps should strive to align these departments and check if these KPIs match the overall business objectives. Gaps must be closed if their KPIs don’t align. iii. Setting RevOps KPIs As you approach the end of the first 30 days, start establishing RevOps-specific KPIs that match company goals, which may involve metrics like revenue increase, conversion rates, or improvements in overall efficiency. 3. Tech Stack Audit Deep dive into the existing tools that your company is using. Identify all redundancies, and find opportunities to streamline the entire tech stack. i. Map Out Tools Compile a list of all tools used by teams, noting their purpose and how they work with the CRM. ii. Evaluate Use and Cost Determine if tools are actively used or if there are duplicates. Look for cost-saving opportunities by consolidating tools when possible. https://www.youtube.com/watch?v=sVDJ9KI1tGw&t=869s Next 30 days – Alignment and Control The next 30 days marks a shift from discovery to alignment. The goals should be to create cohesion between departments (e.g., Sales, Marketing) and laying down effective controls. The improvements need to be implemented without overwhelming the teams. This phase combines