If you are in revenue operations, you already must have a ton of sales data within your arm’s reach.

But which data is most crucial to track and gain insights from?

And which numbers, if tracked right, can have an exponential impact on your revenues?

You can find an answer to this million dollar question with Sales Metrics.

Tracking the right sales metrics can help you redefine your current sales processes and devise strategies that can increase revenue.

Before we get into the details of what these sales metrics you should measure, let’s understand what they mean.

What are Sales Metrics?

Sales metrics are data points that highlight the sales performance of an individual, team or organization.

Sales metrics help an organization to identify how well they are faring in terms of their sales initiatives.

For example, if a certain metric falls below the normal range, it might hint at hindrances that need immediate attention. The good news is that the same value will also shed light on how to solve the problem.

What is the Difference Between Sales Metrics & Sales KPIs?

Sales metrics and sales KPIs might sound interchangeable, but you need to treat them differently. Using the term metric and KPI synonymously can have an impact on your revenue strategy.

So what is the difference?

KPIs or key performance indicators are laser-focused on goals and objectives. KPIs act as a compass that help organizations measure performance specific to certain strategic goals that they set for themselves.

Sales metrics are numbers tracked over time that can be quantified into useful figures. These metrics can be used as guidance and benchmarks for growth. It can exist without a target as opposed to a KPI.

In that sense, every KPI is a metric, but not every sales metric is a sales KPI.

For example, if a business aims to increase sales by 20% by capturing more leads, then sales qualified leads (SQL) could be the KPI and sales revenue can be the sales metric.

Why Should RevOps Teams Track Sales Metrics?

Tracking sales metrics can help revenue leaders can get a clear understanding of what is working in their current sales processes and what is not.

The gaps in sales metrics can help RevOps teams develop strategies to optimize the performance of their sales teams.

Sales metrics can also help you understand areas which are yielding the highest return on investments from sales and where you’re missing out on crucial chances to increase revenue.

A long-term focus on these sales metrics can be a good indicator of your overall sales performance, customer satisfaction levels and how focused you are on creating an efficient team.

For example, if a metric highlights that sales reps quota attainment has been decreasing, revenue leaders can investigate the reasons for the same, and pivot the sales strategy in a way that helps reps close more deals.

Alternatively, if your revenue shows a decline month after month, you can analyze certain sales metrics to figure out why that is so.

Thus, tracking sales metrics help you to:

- Improve your sales team’s overall performance by addressing the bottlenecks in your business.

- Optimize various sales processes by indicating which strategies work best.

- Explore new opportunities by highlighting under-served areas.

- Improve accountability across sales reps and sales managers.

- Help deploy sales coaching in areas that require the most attention.

- Help your buyers and sellers be on the same page.

What Sales Metrics Should RevOps Teams Track?

Your sales metrics selection would depend on what phase of growth you’re in, the resources you have and the strategic goals you have set out for your business.

Identifying the right sales metrics will depend on the KPIs that you have decided to set for your business.

For example, if one of your strategic goals is for all your reps to attain their quota, you might want to track sales activity metrics such as calls made, emails sent or follow-ups.

The must have metrics always have to scale back to the actual company metrics. So the first and most important thing is having an understanding of your current state. Where are you today? Being real about those numbers and not fluffing them up. And then starting to track the progression over time.

cliff simon, cro at the carabiner group

While measurement is crucial for any business, knowing what to measure on is what matters. Understand and manage those metrics that align with your revenue goals, and use it to gain success in the long-term.

The key is to keep it simple, focused and targeted to truly meaningful data. These metrics should help your sales team perform well, reach their targets and pivot wherever necessary.

Here are some crucial sales metrics that you can track on the basis of your strategic goals:

Top Sales Metrics to Track in 2023:

1. Annual Recurring Revenue

Annual Recurring Revenue or ARR is a sales metric for subscription based businesses. It calculates the value of revenue that a company expects to generate from its customers on an annual basis.

ARR is a predictable metric and can be expected to occur with certainty at regular intervals in the future.

Annual Recurring Revenue can be tracked as per specific segments such as location, type of customer, product line etc. to understand performance around these areas.

This is also a useful metric that helps in measuring value added through new sales, renewals and upgrades, and lost off momentum in downgrades and lost customers.

ARR Formula:

For example, if a customer signs a $5000 contract for 5 years, the ARR would be $5000/5, which is $1000 per year.

Similar to ARR is monthly recurring revenue or MRR which measures shorter term subscriptions. It calculates the total amount of revenue your sales team expects to bring in each month.

2. Average Deal Size

Average Deal Size is the total revenue generated in a chosen period of time divided by the number of closed won opportunities for that segment.

This sales metric is useful for projecting sales revenue. It can help sales teams estimate how many deals they must close to reach their quota over a given time period.

Sales managers can review average deal size captured by individual sales reps to know of large deals that might require close monitoring or spot which reps need coaching on a specific large deal to be able to close it.

Average Deal Size Formula:

For example, if a company closes four deals in a quarter of $20,000, $30,000, $10,000 and $20,000, the average deal size would be $20,000 for that quarter.

3. Average Revenue Per User

Average revenue per user (ARPU) or Average Revenue Per Account (ARPA) is the amount of revenue a company generates per user or per account in a given period.

An increasing ARPU over time suggests a customer’s willingness to pay for a company’s products or services. A decreasing ARPU might mean making a sales team consider offering a higher-priced premium service or a value-add feature to the existing subscription that complements the service.

ARPU can be tracked as per specific segments such as location or customer groups. This can help see which segments generate more revenue and which ones need improvement.

ARPU Formula:

For example, if a company generates $300,000 total revenue in Q2 with an average of 3000 customers, its ARPU for Q2 will be $100.

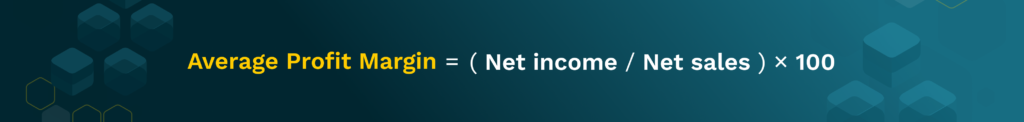

4. Average Profit Margin

Average Profit Margin measures how much of overall sales revenue converts into profit. This is the money that remains after you deduct business expenses.

This sales metric measures how profitable your pricing strategy is and how efficiently you curb expenses and maximize the cost price for your product.

A business can measure its average profit margin across segments like products, services, geography, etc.

Average Profit Margin Formula:

Net income is the total income derived after subtracting total expenses from total revenue. Net sales is calculated by total returns or refunds from total sales.

For example, if a specific product in a certain territory generates $100,000 in net income, and its net sales is $400,000, its profit margin would be 25%.

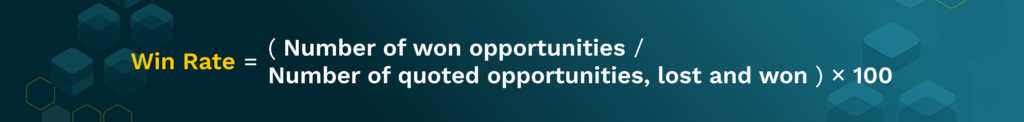

5. Win Rate

Win Rate refers to the percentage of the total number of proposals made that convert into actual sales.

By calculating win rates for each sales rep, sales managers can track individual performance. They can also calculate the number of future sales opportunities required to meet targets.

Win Rate Formula:

For example, if a sales rep closes 20 deals out of 50 that were quoted, their win rate would be 40%.

6. Conversion Rate

Conversion Rate in sales is the percentage of qualified leads that convert into paying customers.

By tracking this sales metric over time, you can understand what it takes to convert qualified leads into paying customers.

It can help enhance the quality of qualified leads that come through, enabling your sales team to focus on the most relevant buyers.

This sales metric can also help measure the performance of individual salespeople, sales teams and marketing efforts.

Conversion Rate Formula:

For example, if a sales rep converts 6 out of 60 qualified leads into paying customers, the conversion rate is 10%.

7. Churn Rate

Churn rate is the percentage of customers who either cancel their subscription or do not renew it for the next period.

This is a critical sales metric as it reflects a company’s ability to retain its paying customers.

Rising churn rates over time could indicate a problem with the company’s products, services or sales approach. Identifying the reasons for increasing customer churn can help companies rectify their loopholes and devise retention strategies that work.

Churn Rate Formula:

For example, if a company begins a quarter with 3000 customers and ends the quarter with 2000 customers, the churn rate would be 33.33%.

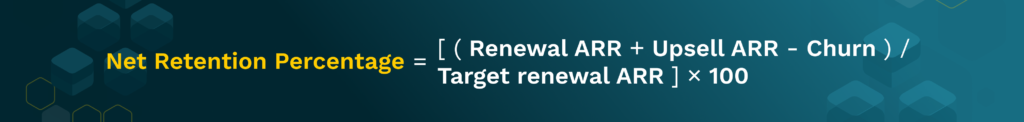

8. Net Revenue Retention Percentage

Net revenue retention is the percentage of a company’s recurring revenue over a given period of time from its existing customers.

Net revenue retention is the total revenue that comes from renewal and upsells, minus any revenue churn.

A healthy net revenue retention score shows how successful your teams have been in retaining their existing customers or upselling.

Net Revenue Retention Formula:

For example, if a company has 100 customers that each pay $2000 per month, its net revenue is $200,000 for that month.

10 more customers add a $200 monthly upgrade ( +$2000; renewal revenue total becomes $202,000), 10 downgrades by $100 each ($202,000 – $1000 = $201,000) and 10 customers cancel their subscription of $200 monthly ($201,000 – $2000 = $199,000).

The new revenue retention percentage for this company will be ($199,000/$202,000), which is 98.51%.

9. Quota Attainment

Quota attainment is the percentage of deals that reps close in accordance with their goals for that period of time.

This sales metric is a great way to understand how effective reps are in following their sales process. It also identifying any obstacles that prevent reps from meeting their quotas.

Revenue leaders can use this metric to evaluate their A-players and understand what processes make them successful to share it with the entire sales team.

Tracking quota attainment can help identify underperforming reps who might benefit from coaching or guidance in specific areas.

Quota Attainment Formula:

For example, if a sales reps quota is $25,000 in a quarter and they could close deals worth $10,000, their quota attainment would be 40%.

10. Sales Cycle Length

Sales cycle length is the average amount of time that it takes to complete a sale. This period starts from the first interaction with a potential customer to the time when a sale is made.

On an average, everyone on your sales team might say that a deal cycle is between three to six months.

If you go into the micro level, you might realize otherwise. For instance, an enterprise deal might take a year to close. While an SMB deal might be taking just a month.

Similarly, at an individual level, one sales rep might be closing deals faster than the rest.

Understanding these nuances is critical so that the processes can be mended and made better accordingly.

Sales Cycle Length formula:

For example, if there are three deals that close in a month taking 10, 20 and 24 days respectively, the total number of days to close all deals would be 55 days.

The average sales cycle length in that case would be 54 divided by the total number of deals, which is 3 in this case. The average sales cycle length would be 18 days.

11. Pipeline Coverage

Pipeline coverage is the ratio of the number of opportunities that exist in the pipeline to sales quota.

The general rule is to have 3x to 4x pipeline coverage. How you calculate this ratio will vary according to your business segment, product, sales cycle length etc.

This sales metric can help sales managers adjust strategies to increase chances of meeting quotas by keeping their pipelines full.

Pipeline Coverage Formula:

For example, if a sales rep has $400,000 worth of pipeline in a quarter and the quota is $100,000, then they have 4x pipeline coverage.

12. Sales Activity Metrics

Sales activity metrics are the data points that depict the performance and behavior of your sales team. It captures every action that your sales team is undertaking to close a deal.

These activity metrics can include emails, calls, meetings booked, type of content shared, marketing campaigns, etc.

Sales activity metrics act as leading indicators to determine whether a deal has a potential to close or not.

For example, a rep might have a full pipeline but no conversations happening with a few prospects. They might be overly optimistic about all these deals. But when you look closer, you see a lack of activity in engaging those accounts. This will be your moment for your sales manager to coach the rep on the next steps.

Access to real-time data about rep’s behaviours allows managers to pay attention to what matters, rather than relying on gut-based decisions.

13. Lead Scoring

Lead scoring is a way to rank prospects or leads on the basis of their engagement with your sales team. This score is assigned to leads on a variety of factors such as buyer behaviour, frequency of interactions etc.

The higher the score, the better the lead. By assigning a score to your leads, you can differentiate between those that qualify and those who don’t.

This saves valuable time for your reps in going after the right leads that have a higher chance of converting.

CRM systems that automate lead scoring with the help of AI eliminate leads that might lead to resource wastage. With artificial intelligence, this scoring “gets smarter” as more data gets fed into the system.

Eliminating leads that have low chances of converting can save a lot of rep time. It can allow your reps to focus on deals that matter. This can have a significant impact on revenues if viewed at scale.

14. Customer Acquisition Cost

Customer acquisition cost (CAC) measures the amount of money needed to acquire a new customer.

Knowing this cost can help companies make the right investment in their marketing and sales efforts.

Identifying the current cost of customer acquisition can reveal how much your business spends and earns from sales and marketing strategies.

CAC also gives a perspective on what your customers need, which helps create better strategies for the future.

CAC Formula:

For example, let’s assume a company spends $200,000 on sales and $300,000 on marketing in a given quarter. In the same time period, the company acquired 500 new customers.

The CAC for this business would be $1000.

15. Customer Lifetime Value (CLV)

Customer lifetime value is the total amount of money that a customer will spend during their lifetime on a product/service. This period is calculated from the time of acquisition to the end of a relationship with a business.

As a sales metric, CLV can help identify how well your brand resonates with your target audience.

CLV can tell you how you can improve to earn customer loyalty. This can help increase revenues in the future with the right kind of customer retention strategies.

CLV Formula:

Where average customer value is the average purchase value multiplied by the average number of purchases.

Average purchase value is calculated by dividing total revenue by the number of purchases in that same period.

Once average customer value and average customer lifespan is determined, use that data to calculate customer lifetime value.

Final Thoughts

Numbers only make sense when they tell a story that helps you make the right decisions for your business. And revenue operations is supposed to be that tide that raises all boats and steers all departments towards common goals.

Evaluate where you stand today, determine where you want to be and measure the core metrics that help you reach your company specific goals.

If you’d like to learn more about metrics of anything related to revenue generation, you should check out our exclusive podcast – The Revenue Lounge!