In a world where every organization is looking to acquire new customers, an often overlooked source of revenue is – Revenue Retention.

Revenue made by retaining customers is the lifeblood of a successful organization. Retained customers often have higher lifetime value, reflecting their satisfaction and loyalty. Satisfied customers also contribute to a positive brand image and word-of-mouth referrals, giving companies a competitive edge.

Moreover, long-term customer relationships offer opportunities for cross-selling and upselling, while their feedback helps businesses refine and enhance their products and services, ultimately driving sustained growth and success.

Revenue retention is pivotal for companies because it signifies the ability to sustain existing customer relationships and, consequently, maintain a stable revenue flow. Retaining customers not only lowers customer acquisition costs but also bolsters long-term profitability and growth.

To measure the revenue for retained customers, companies often use a metric called Gross Revenue Retention (GRR).

What is GRR?

Gross Revenue Retention refers to a business’s capacity to keep its current customers. When a business successfully holds onto its customers, it maintains its revenue. In more straightforward terms, Gross Revenue Retention is the percentage of customers a business manages to keep at their current pricing or contract value.

It stands as a pivotal customer retention metric for subscription-based companies and those operating in the SaaS industry. The comprehension and monitoring of GRR enable them to assess the overall efficiency of their customer retention tactics.

The significance of Gross Revenue Retention goes beyond customer retention; it also functions as a gauge for prospective investors who consider this ratio when assessing a company’s investment suitability.

How to Calculate GRR

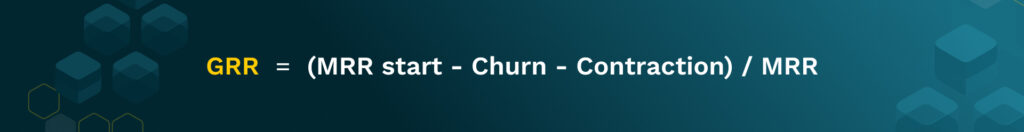

The Gross Revenue Retention rate formula measures the percentage of current customers retained over a specific timeframe. You can determine it using the following GRR formula:

In this equation, MRR start represents the Monthly Recurring Revenue at the beginning of the month. This figure represents the recurring revenue at the outset of any period for which we want to compute the Gross Revenue Retention.

Churn signifies the decline in revenue resulting from customers canceling their subscription or terminating their contract with the company. It represents a total revenue loss.

Contraction, on the other hand, denotes the reduction in revenue caused by customers switching to a less expensive subscription plan. It entails a partial revenue loss since the customer’s revenue has decreased, but the revenue stream is not completely terminated.

Let’s consider a quick example to calculate GRR for company XYZ, using the following financial figures:

– Monthly Recurring Revenue: $15,000

– New Sales: $2,000

– Upselling to existing customers: $2,000

– Customer Attrition (Churn): $1,000

– Customer Downgrades: $1,000

By using Gross Revenue Retention rate formula:

GRR = (15,000 – (1,000 + 1,000)) / 15,000

GRR = (15,000 – 2,000) / 15,000

GRR = 13,000 / 15,000

GRR = 0.8667 (rounded to 2 decimal places)

GRR = 86.67%

As mentioned earlier, the calculations do not include new sales and upselling. After this calculation, we find that XYZ SaaS company has a GRR of 86.67%, indicating that it successfully retained 86.67% of its revenue from existing customers.

Apart from GRR, another popular metric used by organizations to measure revenue retention is NRR.

What is NRR?

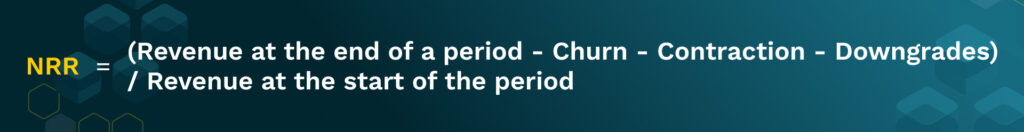

Net Revenue Retention (NRR) is a customer retention metric that assesses a company’s ability to grow its revenue from existing customers. It considers the revenue generated from current customers while considering any losses due to churn, contraction, or downgrades. NRR provides insight into the overall health of a company’s customer base and its effectiveness in retaining customers and expanding revenue from those customers through upselling or cross-selling.

The formula for calculating NRR is as follows:

A positive NRR value indicates that a company is retaining its existing customers and increasing revenue from them. Conversely, a negative NRR suggests that losses from customer churn, contraction, and downgrades are outpacing revenue growth from the existing customer base.

Gross Revenue Retention vs Net Revenue Retention

Gross Revenue Retention (GRR) and Net Revenue Retention (NRR) are two important financial indicators that underscore a company’s capacity to hold onto customers and sustain its revenue.

The key difference between GRR vs. NRR centers around whether expansion revenue is considered.

GRR concentrates solely on revenue derived from current customers without factoring in any supplementary income stemming from upsells, cross-sells, or upgrades. This metric offers insights into your company’s ability to maintain its fundamental revenue streams over time.

The greater the proximity of GRR to 100%, the more favorable the situation. However, this is contingent on the size of the customer base. Small and medium-sized businesses (SMBs) tend to experience higher churn rates and lower retention figures.

Conversely, NRR considers retained customer revenue while also incorporating growth-related activities, like opportunities for upselling and cross-selling to existing clients. NRR presents a more holistic view of your company’s overall retention performance.

NRR serves as a useful tool for business owners and stakeholders to assess the business’s expansion. It functions as a growth indicator, offering insights into the effectiveness of cross-selling and upselling strategies.

An NRR value greater than 100% signifies growth, while NRR at 100% denotes a static business. When NRR is below 100%, it indicates a decline. According to advisor Dave Kellogg, a solid median NRR for private companies stands at 104%.

It’s important to emphasize that NRR exclusively considers existing customers. To gain a comprehensive understanding of the business’s performance, it’s advisable to combine NRR with other metrics.

Now that we have understood the difference between Gross Revenue Retention vs Net Revenue Retention, let’s understand the importance of tracking GRR for companies.

Importance of GRR

As mentioned before, Gross Revenue Retention serves as a stability gauge for SaaS companies, revealing the initial revenue at the start of a period and how much has been eroded by the end.

SaaS firms monitor GRR to gauge how strongly customers have either severed ties with or weakened their connections to the company. A higher customer loss may signal potential problems with customer success. When GRR shows a decline in revenue retention, it can serve as a warning for the company to investigate underlying issues such as ineffective customer success strategies, customer dissatisfaction, recurring glitches in the SaaS product, or any other factors that could undermine customer loyalty.

GRR serves as a barometer for customer satisfaction and loyalty, identifies potential issues, and helps companies focus on long-term customer value. GRR is vital for financial planning, competitive advantage, and investor confidence, making it an essential tool for sustaining and growing a business.

How Can Companies Improve GRR

Companies can enhance their Gross Revenue Retention (GRR) by focusing on customer satisfaction, providing excellent customer support, and continuously adding value to their products or services. This involves identifying and addressing customer pain points, offering proactive assistance, and actively seeking feedback to improve their offerings.

Let’s have a look at each of these points in detail:

1. Improve customer satisfaction

Customer satisfaction plays a pivotal role in shaping gross revenue retention as it reflects the level of contentment customers derive from their overall product or service experience. In essence, dissatisfied customers tend not to come back for another unfavorable experience.

Companies can assess customer satisfaction through surveys, feedback channels, and customer reviews.

For instance, enterprises like Amazon have established a prosperous track record by prioritizing exceptional customer service and support. Their dedication to fulfilling customer needs has led to consistently high retention rates and year-over-year revenue growth.

2. Better products and services

Another crucial element of Gross Revenue Retention (GRR) is the caliber of your product or service. Higher quality offerings tend to result in more contented customers, increasing their likelihood of remaining loyal and continuing their patronage.

Dedicating resources to the ongoing enhancement of your product or service can lead to a gradual rise in GRR over time.

For example, consider a SaaS company that consistently releases software updates featuring new functionalities inspired by customer input. This proactive approach could lead to an enhancement in GRR, as customers have fewer incentives to switch to alternative competitors who may not prioritize their specific requirements.

3. Instant Customer Support and Care

Swiftly addressing customer inquiries and feedback demonstrates your commitment to meeting their needs and addressing their issues. When customers face problems or wish to share suggestions, they anticipate a timely company response.

To prevent customer dissatisfaction, companies should ensure their customer support team is quick and attentive. They should also establish clear communication channels like live chat or email, allowing customers to easily seek assistance.

Research indicates that businesses that promptly attend to customer queries tend to achieve higher customer satisfaction levels and are more likely to foster repeat business. This underscores the significance of implementing efficient processes for monitoring and promptly addressing customer concerns.

You can measure your GRR with greater clarity across the revenue funnel by streamlining your operations. To measure these KPIs correctly and ensure alignment, the first step is to build a robust revenue operations (RevOps) framework. Tools like Nektar can help you do just that!

About Nektar

Nektar is the world’s first AI-backed platform for revenue operations. As an organization, you might have visibility to 10% of your customers. Nektar enables you insights into the remaining 90%.

With Nektar you can:

- Plug CRM data gaps, historical and ongoing, using AI time travel

- Surface new pipeline and hot leads from seller conversations and champion movement

- Transform Slack or MS Teams into an early warning system to mitigate revenue risk proactively

- Fix your CRM data before you unlock generative AI capabilities for your GTM process

To know more about Nektar’s capabilities and retain your hard earned revenue, contact our team of experts today.