In today’s business world, where data is the currency of success, the significance of automated data capture cannot be overstated. In the pursuit of efficient revenue operations and intelligence, organizations are turning to AI and automation platforms that streamline data collection and analysis.

This blog embarks on a comparative journey, shining a spotlight on five trailblazing platforms – Nektar.ai, Clari, People.ai, Gong, and Einstein Activity Capture – all united by a shared focus on automated data capture.

Each platform boasts the promise of automating data capture, harnessing artificial intelligence, and delivering actionable insights to supercharge revenue operations.

We will delve into their core functionalities, unique strengths, and how they empower businesses to revolutionize their sales strategies.

Whether you are looking to refine your sales forecasting, enhance opportunity management, or gain deeper pipeline visibility, this comprehensive analysis will guide you in selecting the ideal revenue operations and intelligence solution tailored to your organization’s needs.

Let’s dive in and uncover the transformative potential that lies within these cutting-edge platforms!

Nektar

Nektar.ai was founded in 2020 with a vision to enable GTM teams to take control of revenue leaks with a purpose-built AI data foundation that unifies accurate, clean, timely revenue data, automatically at scale.

Claim to Fame

Nektar is popular for its AI-powered automated data capture capabilities that sync contacts, emails, and calendar meetings from sales communication to Salesforce. This is done for ongoing activities as well as historical GTM activities. It supports all customer-facing teams – from business development and sales to customer success and account management. For this reason, revenue operations and revenue leaders choose Nektar to gain a 360º view of their customers.

Pros:

- Captures historical and ongoing contacts and GTM activities to deliver pristine CRM data

- Presents the buying committee in every deal by enriching contacts with job titles and the corresponding buyer role (influencer, decision maker, economic buyer, etc)

- Automatically links captured contacts to relevant open opportunities as OCRs

- Automatically classifies activities as per the sales or CS process to provide insights on the types of activities sellers/CSMs are spending their time on

- Captures calendar events, including recurring events and updates made to the event (participants or schedule)

- Always on reporting where ‘Actionable’ insights are delivered on Slack, email, or MS Teams – the power of a dashboard without the dashboard

- Continuously maintains the CRM data by updating and correcting the captured data

- Works for every customer-facing team, not just sales

- Supports data capture for partnership/channel/alliance teams as well

Cons:

- Best suited for companies with 10+ sellers.

Clari

Founded in 2012, Clari emerged with the mission to revolutionize sales operations through AI-driven insights and predictive analytics. Since its inception, Clari has been dedicated to helping sales teams optimize performance and revenue growth with its innovative technology.

Clari’s platform is built for frontline teams as well as sales leadership teams. Today, it boasts several capabilities that include automated data capture, opportunity management, mutual action plans, conversation intelligence, and forecasting.

Claim to Fame

While Clari offers an extensive platform for sales analytics, it is appreciated by sellers and leaders specifically for its forecasting capabilities. As such it is popular among sales teams more than any other revenue-facing team.

Pros:

- Clean visuals and UI

- Customizable dashboards

- ‘Funnel view’ of the pipeline

- Visibility into current & projected pipeline

- Introduced conversation intelligence recently (easier to consolidate tools)

Cons:

- Several contacts are not captured on Salesforce

- Syncing activities into Opportunities on Salesforce is not always accurate

- Salesforce sync has issues

- User adoption is a potential risk, and requires constant enablement

PeopleAI

People.ai was founded in 2016 to transform sales and marketing operations through AI-driven automation and data analysis. People.ai‘s platform focuses on capturing and analyzing sales activities to provide valuable insights and enhance sales effectiveness. Since its establishment, People.ai has claimed to be utilizing artificial intelligence to streamline sales processes and improve revenue outcomes.

Claim to Fame

People.ai started to become popular for its account planning and management capabilities with a focus on enabling sellers on corresponding playbooks. Given this, it is popular among sales teams, with considerable interest from marketing teams, specifically in companies that pursue ABM, since it also captures contacts better than the other heavyweights in this category.

Pros:

- Monitor the adoption of sales playbooks and their compliance

- Capture contacts, emails, and meetings in linear sales communications

- Provides good insights into buying committee members

- Easy-to-use interface for sellers to update a CRM

Cons:

- Data capture is not as extensive or accurate

- Engagement insights not as granular

- Not flexible, requires support for customization

- Insights are not as extensive as other vendors

- Data privacy is not as strong, given its operating model

- UI is not very friendly, requires continuous training/enablement

- Support can be slow

Gong

Founded in 2015, Gong is a pioneer in conversation analytics for sales teams, utilizing AI to analyze customer interactions, meetings, and calls. Gong.io‘s platform provides valuable insights into (verbal) sales conversations, helping teams refine their strategies and manage sales meetings better. With a focus on improving sales performance, Gong has become a prominent player in the field of AI-driven sales analytics since its inception.

Claim to Fame

Gong became popularly known for helping sales leaders coach their teams on handling sales meetings better through its conversation intelligence capabilities. It’s accuracy and depth of insights in conversations are best-in-class. And so, while it started out as a tool for sales teams, it has since become popular among customer success and prospecting (SDR/BDR) teams as well.

Pros:

- Ability to ramp new sellers faster and coach reps better

- Good for all customer-facing teams given its focus on conversation intelligence

- Provides alerts when specific keywords get mentioned in sales calls

- Extensive integrations available along with deep insights in conversation-based engagement

Cons:

- Only conversation intelligence is widely used which casts doubt on ‘value for money’

- Data captured on Salesforce gets removed when Gong is pulled out

- Data enrichment requires building Salesforce Flows and is not done by Gong

- Operationalizing Gong data in Salesforce is challenging due to its isolated and confusing data model

- Adoption of the entire platform requires vast training

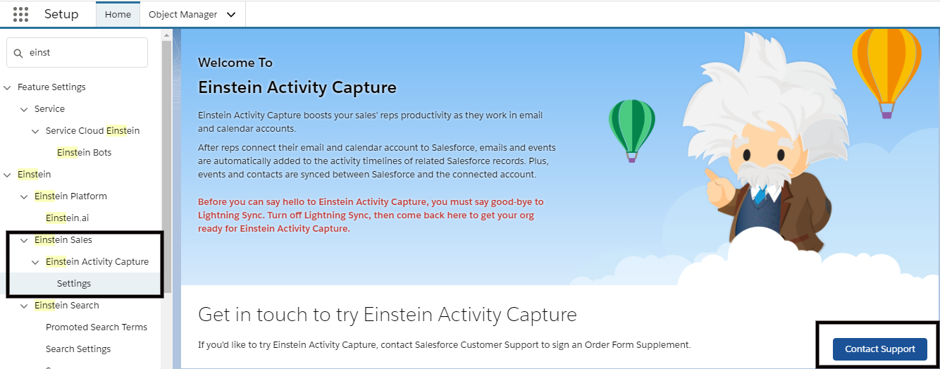

Einstein Activity Capture (EAC)

Einstein Activity Capture is a feature within Salesforce. It was introduced to enhance sales and productivity by automatically capturing and logging customer interactions, emails, and calendar events. While not a standalone company, Einstein Activity Capture reflects Salesforce’s commitment to leveraging AI to streamline sales processes and improve data accuracy. This feature is part of Salesforce’s broader Einstein AI suite, designed to empower sales teams with intelligent insights and automation capabilities.

Claim to Fame

EAC is a more holistic solution than Salesforce Inbox because it captures calendar events in addition to emails. It became popular become it is/was much more affordable (since it’s an add-on) than the alternatives. Given its proximity to Salesforce (sales cloud), it is only popular among sales teams.

Pros:

- Access to the Activities Dashboard and Activity Metrics

- Send emails directly from Salesforce

- Emails, inbound and outbound, get auto-captured and displayed in the activity timeline

Cons:

- Captured data is stored on AWS and not on Salesforce

- A maximum of 6 months of captured activity data is stored

- Activity data is not reportable via SFDC reports

- Limited customization options for capturing data

- Captured data is not owned by you

- Captured data is lost when switching from EAC

Things to Consider Before Investing

The sales tech landscape is vast and complicated. Almost every sales tool has a considerable overlap with another – without even being in the same category.

1. Depth & Breadth of Data Capture

For any sales tech tool, and more so for revenue operations and intelligence tools, data is a foundational element. These tools are specifically brought in to provide meaningful visibility in the form of relevant insights. So if the quality of input data is poor, so are the insights. Garbage in is garbage out.

When it comes to data, there are multiple dimensions to look at:

a. What data gets captured?

- Is it just emails? is it emails and calendar events? Is it contacts as well?

- Not all tools capture all 3 – emails, events, and contacts. Most only capture emails and events/meetings.

- Tools like Nektar that also capture contacts and leads automatically can also help marketing teams for their campaigns. Secondly, capturing contacts helps sales leaders and revenue operation teams gain deeper engagement insights because every activity gets correctly attributed to the right contact. Often times, these contacts are missing in a CRM, and so even if activities get captured by a tool, engagement insights are not accurate.

b. Does the captured data get enriched?

- Capturing the data is just one part of the process. To really make it beneficial, a good tool is capable of enriching the captured data based on data points from other sources.

- For example, Nektar is able to automatically add buyer roles based on job titles. This provides visibility into the buying committee, which is important to monitor buying committee coverage.

c. Is captured data continuously AND automatically maintained, or is it just a one-time capture?

- Stale and incorrect data have no value. A good tool is able to automatically update outdated records and correct the incorrect records when fresh data is captured.

- Nektar is #1 in this. It puts a CRM in a continuous self-healing mode by continuously maintaining the captured data in the CRM.

d. Is the data getting added to a CRM or is it added to its own platform/database?

- Quite often, most tools add the data into their own platform to power their analytics capabilities. This is compensated by a ‘Salesforce sync’ that is marred with issues.

- Secondly, only that data is captured which is needed by their analytics capabilities. This data may not complete the CRM data.

- Nektar first puts all the data into the CRM. This clean and complete CRM is then used to power its analytics capabilities.

e. To what level does the captured data get synced in a CRM?

- Most tools in this space sync the captured data only in Accounts (on Salesforce). None do it at an opportunity level.

- Nektar syncs contacts, emails, and events in accounts AND open opportunities. This makes it useful for precise and in-depth visibility into opportunity management.

2. Configurability

Revenue is a process. More importantly, it’s a ‘unique’ process. This means the revenue operations and intelligence requirements for any business are unique. However, most solutions are walled gardens that allow you to play within a defined boundary. To expand this boundary, either you’re required to submit feature requests or raise support tickets. While support tickets provide immediate workarounds, feature requests can take long to (1) get accepted and added to the roadmap, (2) get delivered as part of the roadmap.

So when evaluating such tools, do look into how flexible is the product to suit your specific needs. This should include:

- flexibility to customize data capture

- flexibility to configure insights that matter to you

- extent of insights that can be self-configured as and when needed

3. Integrations

No revenue operations and intelligence tool can be standalone, especially in a world where data is critical. It is best if they can all interact with one another.

When looking into integrations, do check the pull integrations – from what sources is the tool capturing data, and the push integrations – to what sources is the tool adding the data.

Pull integrations must include every platform that customer-facing teams use to interact with customers. These include Gmail, Google Calendar, Outlook, Outlook Calendar, Slack, LinkedIn, WhatsApp, Zoom, Google Meet, website chatbots, and so on.

Push integrations must include every platform in which you need customer engagement and contact data. These include BI tools like Snowflake, Tableau, CRMs like Salesforce, Microsoft Dynamics, Pipedrive, marketing automation tools like Pardot, HubSpot, Marketo, customer success tools like GainSight, Churn Zero, and so on.

Of course, this requires a clear vision of what problem is the tool getting hired for. A solid revenue operations roadmap can provide this clarity.

4. Intelligence Capabilities

Revenue leaders seek actionable insights that help them make revenue-critical decisions. But far too often, these insights are buried in dashboards that revenue leaders must access, navigate, and interpret every single time. So there is a need to learn and adopt the tool.

But dashboards, reports, or spreadsheets are static snapshots. Revenue leaders must eventually make sense of and translate actions out of the insights retrospectively. Additionally, in most tools, for every new dashboard, a request has to be put in to the admin because only they are trained or have the necessary access to create new dashboards.

A big challenge with dashboards is that from the time an insight is needed to the time the dashboard is created, which is then ingested by a leader to be put into a process, the original need that triggered this process dies off.

5. User Adoption

If your GTM tech stack is already crowded, where sellers are working with 8-15 tools every day and CSMs with 5-10 tools every day, then you need to think twice before investing in yet another tool. Every additional tool after a threshold can have a negative impact without any considerable return on investment.

Not only should the deployment be quick, no/low-code, but the onboarding should be simple without extensive admin training, and as far as possible, end-users should not have to learn yet another tool. Evaluate tools on how easily they fit into your existing workflows, resulting in minimal change management.

So, Which of these is the Best?

Difficult to say, honestly. Each platform brings its unique strengths to the table, from automated data capture to predictive analytics. The real questions are what insights do you need to improve the status quo, and what data do you need to get those insights?

Of course, just one of the tools can never be a panacea that solves every problem. You will need to combine 2-4 of these tools to get the most optimal result. Choosing the right solution depends on your organization’s needs, but one thing is certain: the fusion of AI, automation, and strategic insights is shaping the future of revenue teams, promising a more streamlined and successful revenue journey for all.