As much as 80% of sales organizations miss the mark on revenue forecasting by 25% or more.

That’s a particularly worrying number, primarily because of 3 reasons:

- Global volatility and economic downturn

- Complex buyer journey and sales processes

- Added pressure on revenue leaders to deliver predictable growth

A revenue forecast serves as a guide to achieving realistic revenue goals to tide over unpredictability.

This exhaustive guide lays down everything you should know about revenue forecasts and how to do them right, including: - What is revenue forecasting? - Why is revenue forecasting important? - What are the key foundations of revenue forecasting? - Accurate Forecasting Using Revenue Forecasting Models

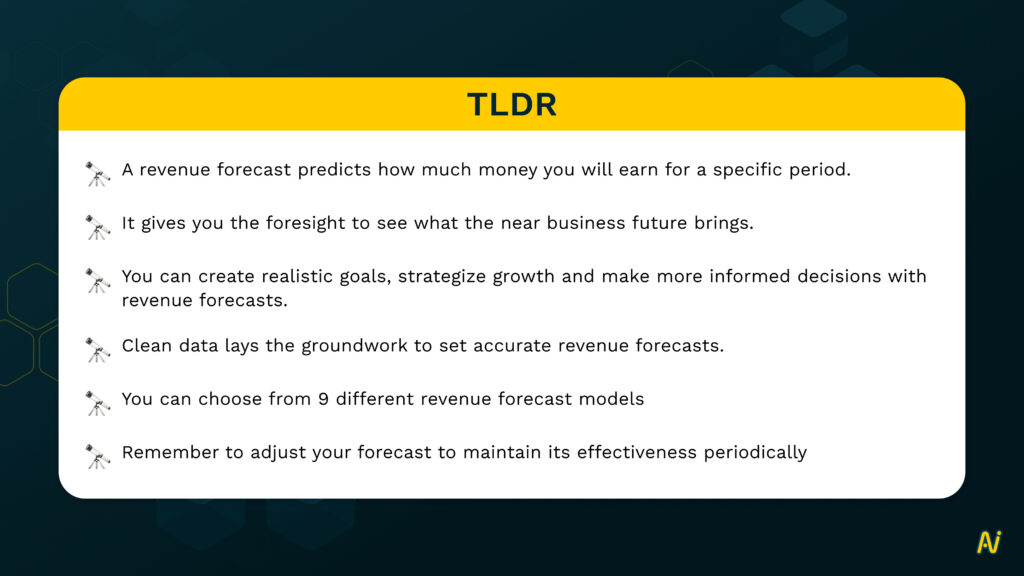

If you’re short on time, here’s a quick summary of this blog:

What is Revenue Forecasting?

Revenue forecasting predicts how much revenue your business may earn for a certain period.

It uses historical data to make educated speculations about the potential revenue. Contrary to common assumptions, revenue forecasts aren’t based solely on quantitative data. They’re also enriched by qualitative data.

To sum it up, revenue forecasting models answer the key business question: How does your current performance take you where you want to go?

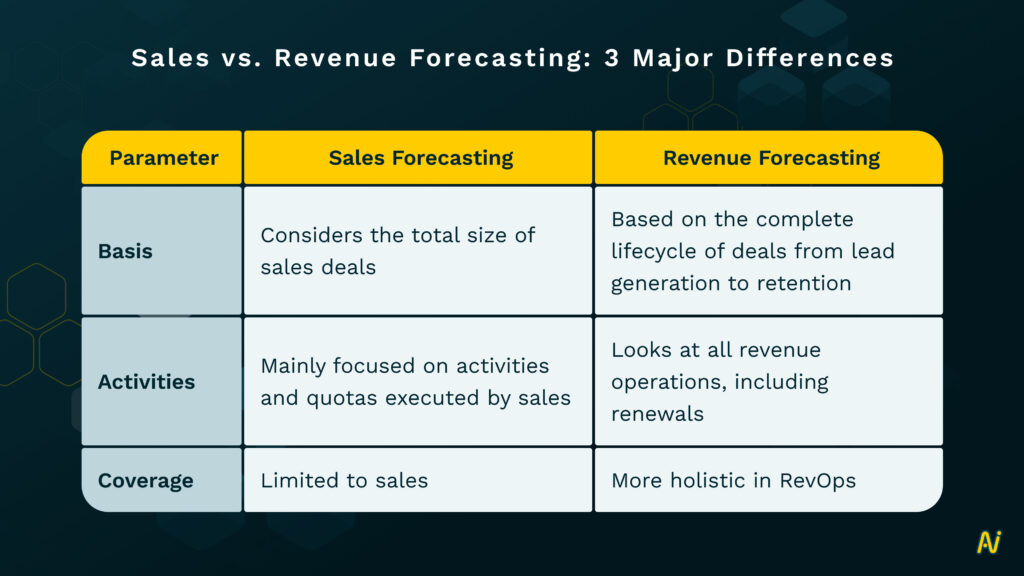

It’s not unheard of, even in SaaS circles, to confuse revenue and sales forecasting. But there are 3 key differences you must know if you want to build accurate forecasts.

Why is Revenue Forecasting Important?

A revenue forecast gives you, quite literally, the “foresight” to see what the future brings. Here’s how you can benefit from it:

1. Know expected revenue & budget

Revenue forecasts give you insight into how much money you can expect to generate from product sales. This, in turn, will give you the information to set up budgets for RevOps and other teams.

On the other hand, you can also track expenses for the period and optimize your cash flow.

2. Strategize growth

You can strategize with key stakeholders by figuring out your expected revenue and budget. These meetings throw light on what actions you can undertake to increase earnings.

Two-thirds of businesses consider revenue process optimization important to achieving customer retention goals. Whereas 63% think revenue strategy is important for adapting to new market expansion.

Revenue forecast provides the basis of growth strategy showing you:

- How quickly can you scale

- What will be your future expansion in terms of earnings, expenses, and markets

- How can you set and adjust revenue goals to bridge gaps between predictions and real-world performance

3. Set appropriate long-term goals

Other than business goals, you can use revenue forecasts to set other long-term goals for marketing campaigns, software purchases, and resource allocation.

For instance, they can be used to decide how much staff you will need in RevOps teams and how many resources you must hire corresponding to each function.

4. Make informed decisions

Revenue forecasts ensure you’re not caught off guard in unpredictable times and can make data-backed decisions with accurate analyses.

For example, while preparing a forecast, you may find that sales for June-July 2022 were lower than the rest of the year.

The first thought would be to attribute this to seasonal demand.

But if you know how to forecast revenue, you dig deeper into the data. Then, you find the underlying reason–your sales head left the company during this time.

You can decide not to base next year’s forecast on the same numbers in June-July 2022.

5. Helps secure funding

Revenue forecasting is responsible for your organization’s general profitability.

To secure funding, you can make serious financial projections (including the profit & loss statement and cash expectations). Investors look at these numbers and decide whether to invest in your business.

Now that the benefits are on the table, you can understand more about what is revenue forecasting and how to create one. To begin, we look at its key foundations.

Key Foundations of Revenue Forecasting

To understand further why revenue forecasting is important, you must take great care in maintaining these 3 foundations:

1. Revenue goal

Revenue goals are realistic financial targets that improve business growth. These targets or goals must be based on actual market data, not gut data.

2. Revenue pipeline

Your revenue pipeline includes active, upcoming, and prospective deals. It acts as a map to show where prospects and existing customers are placed in your sales funnel.

The pipeline is where your leads turn into customers and is, therefore, the primary revenue source.

3. Product delivery

You must track and manage the delivery of your product or solution. This includes monitoring:

- How much of each contract is earned

- How much of it is due in the future

It also covers the management of customer payments and lowering customer churn due to poor delivery.

How to Forecast Revenue Using Models

Businesses primarily use 4 revenue forecasting models. We’ve discussed each one below.

1. Straight Line Revenue Forecast

The simplest of all models, straight line revenue forecast, uses historical data to project revenue growth for a specific period.

It typically assumes that the previous year’s growth rate will remain the same for the next.

The method first determines the revenue growth rate and then calculates forecasted revenue. The formula is:

Current Revenue (1 + Growth Rate / 100) = Revenue Forecast

Let’s break this down with an example.

If you’re experiencing a revenue growth rate of 30% in 2022 with current revenue at $100,000, your forecasted revenue for 2023 will be:

100,000 (1 + 30 / 100) = $130,000

Given its simplicity, the straight line model works best for startups or companies preparing their first revenue forecast.

A few major drawbacks of this method are that:

- It assumes the growth rate will remain constant

- It doesn’t factor in macroeconomic changes

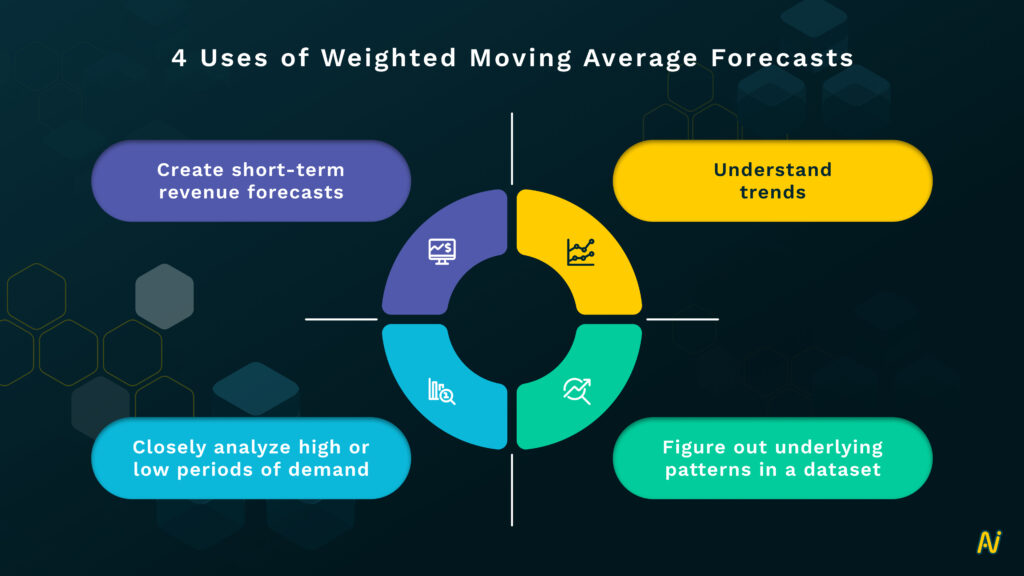

2. Weighted Moving Average Revenue Forecast

The model considers moving averages of historical data to create a forecast.

Most commonly, businesses use 3 and 5-month forecasts. But feel free to explore, experiment and use this for as short as 1 month, too.

You must add weights to each average to build a more accurate revenue forecasting model.

For example, the revenue for Q1 is $3,000, $2,000, and $4,000. You then assign the weights 30%, 20%, and 50%, respectively.

The forecasted revenue for Q1 will be:

(3,000*30%) + (2,000*20%) + (4,000*50%) = $3,300

3. Simple Linear Regression Revenue Forecast

The simple linear regression method forecasts revenue based on the relationship between two variables—dependent and independent.

The dependent variable is the “forecasted revenue,” while the independent variable is the “influencing factor.”

The independent variable has a direct impact on the dependent one.

A simple example of an influencing factor could be “deals won.” The more deals you win, the higher your forecasted revenue. Similarly, if you lose more deals, your revenue will be lower.

Simple linear regression is easy to understand and, therefore, used by smaller organizations. It shows what factor has the highest impact on revenue and how to budget for changes arising from it.

4. Multiple Linear Regression Revenue Forecast

This revenue forecasting model follows the same underlying principle as simple linear regression, except it uses multiple independent variables.

All of these variables account for factors that directly influence revenue.

While the above 4 models are widely used, you don’t need to restrict yourself to just these. Here are some more models you can use for your SaaS business:

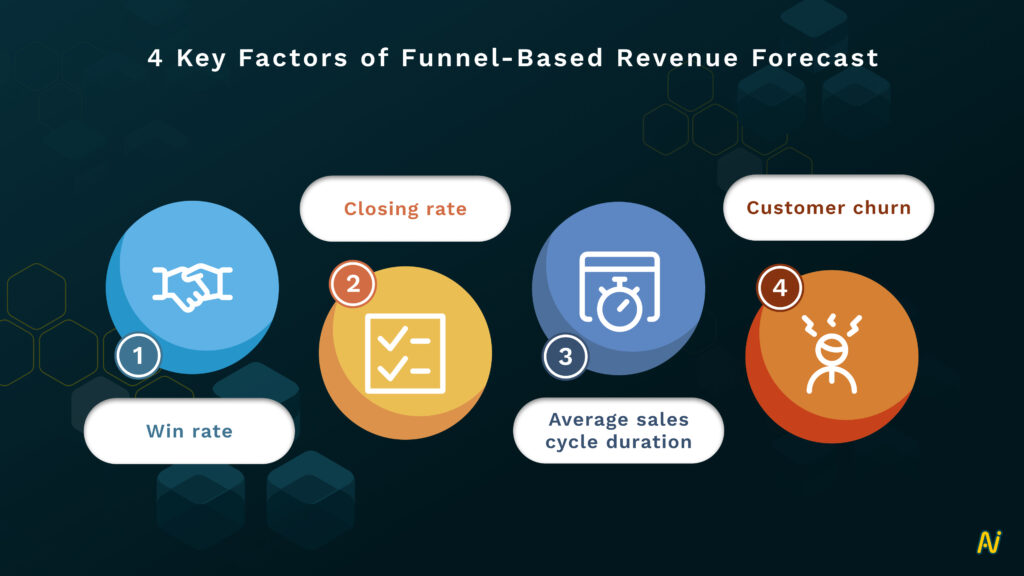

5. Funnel-based Revenue Forecast

Funnel-based revenue forecasting takes on one of the key foundations. It analyzes the sales pipeline from lead generation to retention to predict revenue.

Given its calculations, the model is helpful for deals that are similar in nature, making them predictable.

Here’s how funnel-based revenue forecasting works.

Your pipeline has 10 opportunities, each worth $10,000 and totaling $100,0000. Your generally observed win rate is 50%.

This means you’ll forecast revenue of $50,000 for the specified period.

Funnel-based revenue forecasts heavily rely on your pipeline’s health, hygiene, and coverage. Therefore, keeping your pipeline clean with healthy leads serves best for accurate forecasts.

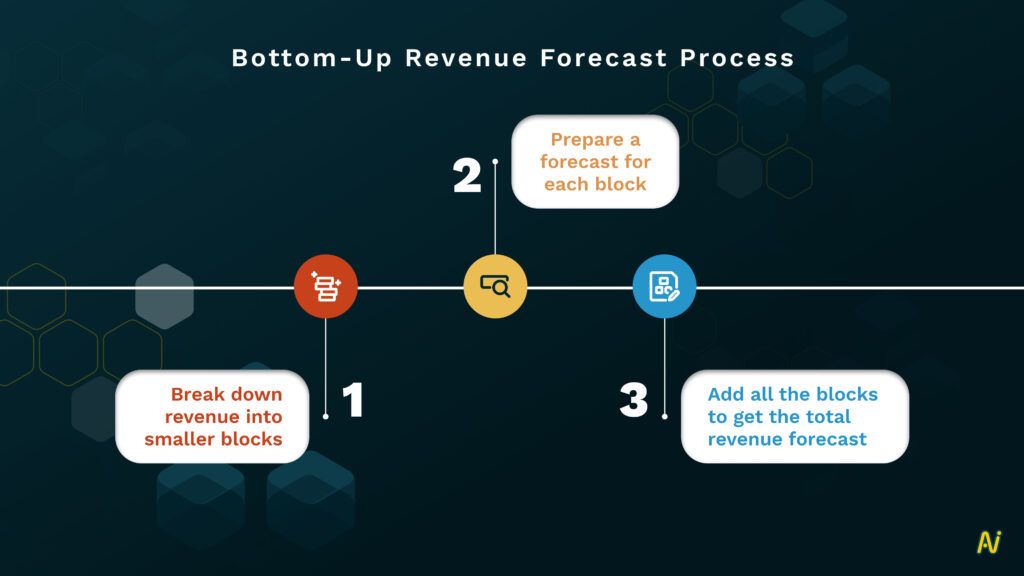

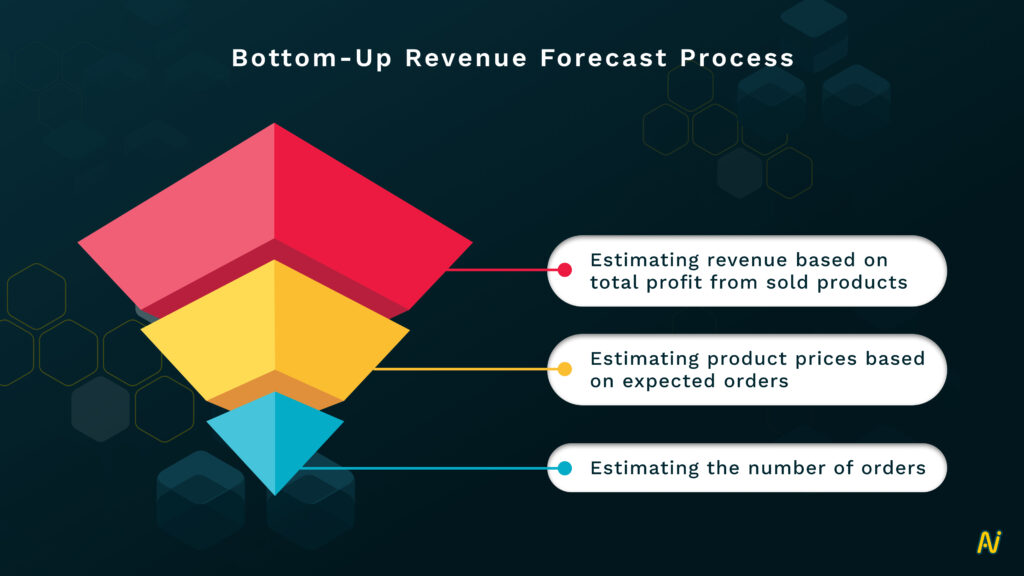

6. Bottom-Up Revenue Forecast

As the name suggests, this approach predicts your company’s future performance by starting with details at the lowest level and working up to revenue.

The bottom-up revenue forecasting model is similar to putting together a puzzle, integrating data from each revenue function, and creating a unified picture.

The good part is that it’s more granular and supports your business decisions with tangible data. But that also means it can be extremely time-consuming.

You must have the time and resources to invest in a bottom-up model to create an accurate forecast.

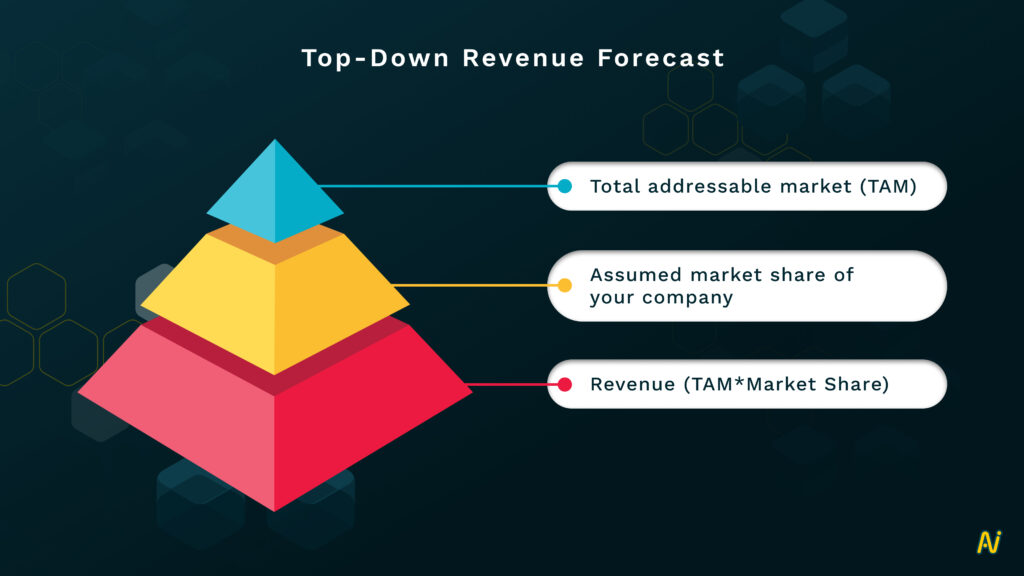

7. Top-Down Revenue Forecast

A top-down revenue forecasting model follows the approach opposite of bottom-down.

It starts with market data at the highest level (the big picture) and then breaks it down into smaller pieces on the way to revenue.

Total addressable market is the total available market for a product or service if 100% market share is achieved.

Market share shows how much of a market you’ve captured in %.

8. Backlog Revenue Forecasting

The approach focuses on contracts instead of revenue received.

Contract = Total revenue contracted but not yet earned

Backlog forecasting isn’t so much focused on uncertainty as it is on the distribution of revenue growth across several contracts.

It tries to understand how much time it takes to earn backlog revenue at the current size of your organizational resources.

An unfortunate drawback is that this model bases its track record on similar deals in the backlog. The timing of the revenue is also based on assumptions.

9. AI-based Revenue Forecast

AI and ML are increasingly used as objective solutions for accurate forecasts.

AI-based models are trained on historical data, assigning weights and scores to factors influencing revenue. Taking it a step further, these models can also be used to:

- Forecast revenue in real-time, and

- Point out variations in actual and estimated revenue.

Over 40% of sales operations leaders identified seller subjectivity as their greatest challenge to forecast accuracy.

That goes out the window if you deploy AI and ML models.

AI models replace adjustments and observations born out of human judgment, giving more importance to data-driven outcomes.

In doing so, they reduce human interference and errors to a large extent.

Best Practices for Accurate Revenue Forecasting

Revenue forecasting models must be continually adjusted to give the most accurate results. We’ve listed 9 best practices that will help you maintain their effectiveness.

1. Set realistic goals

Setting the right revenue number for your forecast is important and must be based on realistic factors.

Don’t rely extensively on intuition over data-driven information to set goals.

2. Define sales funnel stages

Each stage of the sales funnel must be properly defined.

Use these questions to help you:

- What is considered the first interaction between buyer and seller?

- When does a deal become qualified?

- When is a deal won or lost?

What the data team has done is they look at a closed won opportunity. And they determine what is the behavior of a closed won opportunity.

When it moves through each of the stages, how long does it stay at that stage? And when it moves to the next stage, and then the next stage and the next stage, what is the number of days it stays in each stage? What does a healthy opportunity look like?

Don Otvos, VP of Business Development & Alliances, LeanData

3. Accurate financial statements

Make sure you’re tracking past and current projects, plus the revenue incurred from them.

Your balance sheet and income statement must have concrete and data-backed numbers you can rely on.

To gather reliable numbers for more accurate forecasts, centralize your revenue data in one repository.

4. Good pipeline hygiene

Good data plays an extremely crucial role in revenue forecasting.

In the world of revenue forecasts, accurate information equals accurate forecasts.

To ensure good pipeline health, update it every week, if not daily. What’s even better? Automate the pipeline updating process.

Don’t keep old deals in the pipeline. Make sure your numbers are accurate. You need to be updating your pipeline on a weekly basis, if not daily.

…if the information is out of date or inaccurate, you’re going to have inaccurate forecasts.

Craig Baldwin, Co-founder, Upsourced

5. Check variations

Periodically adjust your revenue prediction as situations in your business change. You can investigate the differences between expected and actual revenue numbers.

You need to get granular to understand…whether you’re on track to hit your number or miss it. And then, you can understand from a sales team at a higher level – are we missing our number because we’re not performing well or are we missing our number because we don’t have enough pipeline?

Don Otvos, VP of Business Development & Alliances, LeanData

6. Include teams in the process

Make the most of your revenue teams’ insights by coordinating with them to prepare forecasts.

It helps you understand how reps can achieve targets and how fast they can convert leads to customers. In the process, you also learn about their upcoming campaigns and initiatives.

If you’re performing well against the opportunities you have, there’s a bigger issue of pipeline, which is top of the funnel, right?

Then I would be able to go to the marketing team and say – look, I know the sales team is performing throughout the stages. We need more opportunities at the top of the pipeline.

You can make that argument to the marketing team and, and you can back it up with data and that’s really how you can really provide those kinds of insights from a RevOps perspective.

Don Otvos, VP of Business Development & Alliances, LeanData

7. Account for multiple scenarios

While being cautious may be good, don’t completely ignore optimistic forecasts. You can prepare revenue predictions for both conservative and aggressive cases.

Most of the revenue forecasting models will be based on conservative scenarios. But build at least one set with aggressive projections. List down everything that you want to achieve in a dream scenario.

Breaking out of the cautious mold gives way to creative ideas for achieving business goals.

This process helps develop a bigger perspective, encompassing better possibilities.

8. Don’t ignore external factors

External factors are unpredictable events that influence your business. These may include the most common factors like market trends and serious ones like economic downturns and health emergencies.

9. Avoid manual efforts

Spreadsheets are a conventional, familiar choice for preparing revenue forecasts. They’re popular primarily because you have complete control over the forecasting process.

But the process involves extensive manual effort while also taking up significant time. There’s also the increased possibility of human errors.

I would try not to use spreadsheets. When managing a pipeline, there are a lot of inputs and a lot of variability. And spreadsheets can become a lot of work than it’s worth.

Craig Baldwin, Co-founder, Upsourced

Technology streamlines the process. Various revenue forecasting software based on AI link directly to your revenue data. You can also intelligently manipulate and analyze the data for more accurate forecasts.

Nektar’s Role in Revenue Forecasting

Clean data lays the groundwork for setting the right goals and maintaining a healthy pipeline. Ultimately, it helps build a more reliable revenue forecast.

That’s where Nektar comes in.

1. High-quality data

Clean, complete, accurate, consistent, and compliant data, aka “quality data,” is the underlying influencer of accurate forecasts.

Nektar automates the data capture process to collect complete contact data. It automatically updates data at regular intervals to maintain quality.

2. Historical data

Nektar uncovers hidden and unseen data that fills the gaps for accurate forecasts. AI-based forecasts, particularly, need a good amount of historical data to predict revenue reliably.

3. Unified data

Our revenue solution lets you focus on what’s important by centralizing and processing complete data.

Unified data leads to fewer errors and higher consistency as teams aren’t gathering data points from multiple sources.

You spend less time finding the information you need and more time achieving revenue goals.

Incorporate clean data at the beginning of your revenue forecast process with Nektar.